Real Property Legal Definition8 min read

Real property legal definition refers to the classification of rights in land and things incident thereto. This is a legal term used in many countries all over the world. The definition may vary from one country to another, but in general, it refers to the ownership and control of land and anything permanently attached to it, such as buildings and mineral deposits.

In most cases, real property is owned by individuals, corporations, or governments. It can be leased, mortgaged, or sold, and the owner has the right to use, enjoy, and dispose of it as he or she sees fit. The holder of a real property right is called a “tenant,” “lessee,” “mortgagor,” or “vendor,” depending on the context.

The law of real property is vast and complex, and it can be difficult to summarize it in a few sentences. However, some of the key concepts include:

· the right of exclusive possession;

· the right to use and enjoy the property;

· the right to sell or transfer the property;

· the right to erect structures on the property;

· the right to lease the property to others; and

· the right to collect rent from tenants.

Real property is a valuable asset, and it can be important to protect one’s rights in it. If you are a tenant, mortgagor, or other party with an interest in real property, it is important to seek legal advice to make sure your rights are fully protected.

Table of Contents

What does real property mean in law?

In law, real property refers to the physical land and anything permanently affixed to it, including buildings, trees, and minerals. The term distinguishes this type of property from personal property, which includes everything that isn’t nailed down, like cars and furniture.

In most cases, real property is owned by someone, and that person has exclusive rights to use, sell, or lease it. The owner of real property is also responsible for any damages that occur on the property, even if it’s not their fault.

There are a few ways to own real property. The most common is to hold title to it, which means you have the legal right to control it. You can also own it through a lease, which gives you the right to use it for a specific period of time.

Real property can be bought and sold just like any other commodity, and the sale usually involves a transfer of title. If you’re buying property, be sure to get a title search to make sure there are no outstanding claims against it.

Real property law is complex and can vary from state to state. If you’re thinking about buying or selling property, be sure to consult with an attorney who specializes in this area.

What are 3 examples of real property?

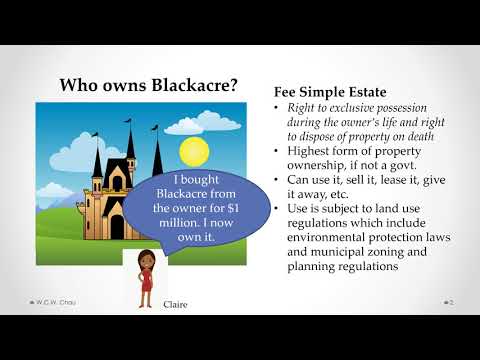

Real property is a legal term that refers to land and anything permanently attached to it, such as buildings, trees, or mines. The term is derived from the Latin term “res”, meaning thing. In the United States, real property is generally divided into two categories: fee simple and leasehold.

Fee simple is the most common form of ownership and confers the greatest amount of rights and privileges to the owner. These include the right to sell, lease, or give the property away. The leasehold estate is a lesser form of ownership that lasts for a specific period of time. It is common in residential leases, where the tenant has the right to use and occupy the property for a set period of time, after which the lease expires and the property reverts back to the landlord.

Other types of real property include:

• Condominiums: A condominium is a type of ownership in which the owner owns the individual unit and the common areas are shared with other owners.

• Co-ops: A co-operative is a type of ownership in which the residents own the building and the land it sits on, and share the responsibilities of managing the property.

• Mortgages: A mortgage is a loan that is used to purchase property. The property is used as collateral for the loan, and the lender has the right to seize it if the loan is not repaid.

Whats the best definition of real property?

What is the best definition of real property?

The definition of real property is the most comprehensive and includes all interests in land and improvements. It is the legal term that refers to the estate in land, which is the bundle of rights that a person has in a particular parcel of land. These rights can be divided into two categories: those that are related to the land itself and those that are related to the improvements on the land. The rights that are related to the land itself include the right to possess, use, enjoy, and dispose of the land. The rights that are related to the improvements on the land include the right to erect, alter, repair, use, and occupy the improvements.

What is the IRS definition of real property?

The Internal Revenue Service (IRS) defines real property as land and anything permanently attached to it, including buildings, fixtures, and other improvements. In other words, real property refers to anything that is not a personal property.

Personal property is generally anything that can be moved, such as a car or furniture. The key distinction between real and personal property is that real property is attached to the land, while personal property can be moved.

For tax purposes, the IRS considers real property to be a more valuable asset than personal property. This is because real property is typically more stable and has a longer life span. As a result, the IRS imposes a higher tax rate on profits from the sale of real property than on profits from the sale of personal property.

There are a few exceptions to the definition of real property. For example, the IRS does not consider standing timber or crops to be real property. Instead, these items are considered personal property since they can be moved.

The IRS definition of real property is important for taxpayers because it determines how they are taxed on the sale of a property. It is also important for property owners because it determines what type of insurance they need. For example, a property owner who owns a house would need homeowners insurance, while a property owner who owns a timberland would need a different type of insurance.

What is not an example of real property?

Real property is a classification of property that refers to land and anything permanently attached to it, such as structures and natural resources. There are several things that are not considered to be real property, including:

1. Intangible assets: This includes things like copyrights, patents, and trademarks.

2. Personal property: This refers to property that is not attached to land, such as cars, furniture, and jewelry.

3. Equity: This is the value of a company’s assets minus its liabilities. It is not considered to be real property because it does not represent a physical asset.

4. Futures contracts: These contracts represent an agreement to buy or sell a commodity or security at a specific price in the future. They are not considered to be real property because they are not a physical asset.

5. Options contracts: These contracts represent the right, but not the obligation, to buy or sell a security or commodity at a specific price in the future. Like futures contracts, they are not considered to be real property.

What is the difference between real and personal property?

There is a big difference between real and personal property. Real estate is land and everything permanently attached to it, such as buildings, trees, and minerals. Personal property, on the other hand, is any property that is not classified as real estate, such as furniture, clothing, and cars.

One key distinction between real and personal property is that real estate is considered an investment, while personal property is not. When you purchase real estate, you are buying a physical asset that can be rented out, sold, or used as collateral. Personal property, on the other hand, generally has little or no resale value and is not considered an investment.

Another key difference between real and personal property is that real estate is usually subject to property taxes, while personal property is not. This is because real estate is considered a valuable asset, while personal property is not.

The final key distinction between real and personal property is that real estate is typically transferred through a deed, while personal property is transferred through a bill of sale. A deed is a legal document that transfers ownership of real estate from one person to another. A bill of sale is a legal document that transfers ownership of personal property from one person to another.

What is not real property?

What is not real property?

Real property is a term used in law to describe land and everything else that is attached to it, including buildings, trees, and minerals. Real property can be owned by individuals, businesses, or the government.

There are several things that are not considered real property. These include:

1. Personal property: This is any property that is not land or a structure attached to it. Personal property includes things like cars, furniture, and jewelry.

2. Rights in gross: These are rights to benefits that are not attached to a specific piece of land. For example, a mineral rights lease gives the leaseholder the right to extract minerals from a piece of land.

3. Intangible assets: These are assets that do not have a physical form. Examples include copyrights, trademarks, and patents.

4. Servitudes: These are rights to use someone else’s land for a specific purpose. An example would be a right of way, which allows someone to cross someone else’s property.