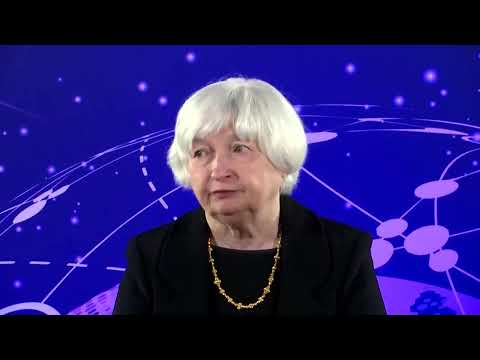

Yellen Wants Encourage Cryptocurrencies For Legitimate9 min read

The chairwoman of the United States Federal Reserve, Janet Yellen, wants to encourage the use of cryptocurrencies for legitimate purposes.

In a speech on Wednesday, Yellen said that the Fed does not intend to stand in the way of legitimate cryptocurrency activity.

“The Fed does not want to stand in the way of legitimate cryptocurrency activity,” she said.

Yellen also noted that the Fed does not think that cryptocurrencies are a threat to the stability of the financial system.

“We do not see a need for the Fed to supervise cryptocurrencies,” she said.

This is a major change in tone from the Fed, which has been largely dismissive of cryptocurrencies in the past.

Yellen’s comments come as the cryptocurrency market experiences a major surge in popularity.

Bitcoin, in particular, has seen its value skyrocket in recent months.

Table of Contents

Is Janet Yellen against cryptocurrency?

Janet Yellen, the Chair of the Board of Governors of the Federal Reserve System, has not explicitly stated her stance on cryptocurrency, but there are several reasons to believe that she is not in favor of it.

First, Yellen has spoken out against the possibility of the Fed issuing its own cryptocurrency. In a speech at the annual meeting of the American Economic Association in January 2018, Yellen said, “Cryptocurrencies are interesting, but I don’t think they are a stable source of value, and I don’t think they are a payment system that would be viable for large-scale transactions.”

Second, the Fed has been critical of Bitcoin and other cryptocurrencies in the past. In December 2017, the Fed issued a report that said, “The prices of Bitcoin and other virtual currencies have been highly volatile and sensitive to news about regulatory actions and technological developments. For example, the price of Bitcoin dropped sharply in December after the announcement of pending regulation in South Korea.”

Lastly, Yellen is not the only member of the Fed who is critical of cryptocurrency. Jerome Powell, who will succeed Yellen as Chair of the Board of Governors of the Federal Reserve System in February 2018, has also spoken out against it. In a speech at the annual meeting of the National Association for Business Economics, Powell said, “I’m not a big believer in Bitcoin. I think it’s a speculative asset.”

Why the government cannot regulate crypto?

Cryptocurrencies like Bitcoin emerged in the aftermath of the global financial crisis. People were looking for an alternative to the traditional financial system, and cryptocurrencies seemed to fit the bill.

At first, governments were hesitant to regulate cryptocurrencies. They saw them as a way of circumventing traditional financial systems and regulations.

However, as cryptocurrencies have become more popular, governments have started to take notice. They are concerned about the potential for money laundering and tax evasion.

Regulating cryptocurrencies is a difficult task. They are a global phenomenon, and each country has its own set of regulations.

Cryptocurrencies are also difficult to regulate because they are decentralised. There is no one authority that can make decisions about how they should be regulated.

Governments also face a number of technical challenges. It is not always clear how cryptocurrencies should be classified under existing regulations.

Cryptocurrencies are also evolving rapidly. New cryptocurrencies are being created all the time, and the technology behind them is constantly evolving. This makes it difficult for governments to keep up with the latest developments.

Finally, there is the issue of public trust. Many people are distrustful of governments and believe that they cannot be trusted to regulate cryptocurrencies fairly.

These are just some of the reasons why the government cannot regulate cryptocurrencies. There are many challenges that governments face in trying to regulate this new technology.

Is the government trying to regulate cryptocurrency?

Since the inception of Bitcoin in 2009, governments around the world have been trying to figure out how to regulate cryptocurrency. Some countries, like China, have outright banned it. Others, like the United States, have been trying to figure out how to legislate it.

The problem with trying to legislate cryptocurrency is that it’s difficult to do. Bitcoin and other cryptocurrencies are not governed by any central authority, which makes it difficult to create laws that govern them. In addition, they are decentralized, which means that they are not regulated by any one entity.

This has caused some problems for governments. For example, in the United States, the Securities and Exchange Commission (SEC) has been trying to figure out how to regulate cryptocurrencies like Bitcoin and Ethereum. The SEC has said that these cryptocurrencies are securities, but it has been difficult to enforce this because of their decentralized nature.

In addition, the Internal Revenue Service (IRS) has been trying to figure out how to tax Bitcoin and other cryptocurrencies. The IRS has said that they are taxable as property, but it has been difficult to enforce this because of their decentralized nature.

So, is the government trying to regulate cryptocurrency? Yes, but it has been difficult because of the decentralized nature of these currencies.

Which cryptocurrency is backed by government?

Government-backed cryptocurrencies are a relatively new concept, but they have the potential to revolutionize the way we think about money. These digital currencies are backed by a government or other authority, which means they are inherently more stable and secure than traditional cryptocurrencies.

There are a few different government-backed cryptocurrencies in circulation at the moment, but the most well-known is probably the Venezuelan bolivar soberano. This digital currency is backed by the Venezuelan government, and it is intended to help stabilize the country’s economy.

Other government-backed cryptocurrencies include the Swiss franc and the Singapore dollar. These currencies are backed by their respective governments, and they are intended to provide stability and security for their respective economies.

One of the main benefits of government-backed cryptocurrencies is that they are more stable and secure than traditional cryptocurrencies. This is because they are backed by a government or other authority, which means that they are less likely to fluctuate in value.

Additionally, government-backed cryptocurrencies can be used to pay taxes and other government fees. This makes them a more convenient option for taxpayers, and it also helps to legitimize them as a currency.

Overall, government-backed cryptocurrencies have a lot of potential to revolutionize the way we think about money. They are more stable and secure than traditional cryptocurrencies, and they can be used to pay taxes and other government fees.

What did Yellen say about crypto?

Janet Yellen, the chair of the United States Federal Reserve, said that cryptocurrency is not a stable store of value.

Speaking at the 2018 Economic Club of New York, Yellen was asked about cryptocurrencies and their role in the economy. She replied that, “Cryptocurrencies are not a stable store of value. They are very volatile.”

Yellen added that she does not see cryptocurrencies as a threat to the stability of the financial system, but she is not completely dismissive of them. “I’m not sure they will ever be significant enough to pose a threat to the financial system,” she said.

Yellen’s comments come at a time when the value of Bitcoin and other cryptocurrencies is falling rapidly. At the time of writing, Bitcoin is worth $6,582, down from a high of $19,771 in December 2017.

Is Bitcoin inefficient?

Bitcoin is often labelled as inefficient due to its high energy consumption. But is this really the case?

Bitcoin miners use a tremendous amount of energy. This is often cited as a reason why Bitcoin is inefficient. However, it’s worth taking a closer look at the numbers.

First of all, it’s important to note that the high energy consumption of Bitcoin miners is not a new development. Miners have been using a lot of energy for a long time. In fact, the energy consumption of Bitcoin miners has actually decreased in recent years.

Second, it’s worth noting that the energy consumption of Bitcoin miners is not as high as some people make it out to be. In fact, it’s a fraction of the energy consumption of other industries.

Third, the high energy consumption of Bitcoin miners is justified by the benefits that Bitcoin provides. Bitcoin is a secure, global, and digital currency that has the potential to revolutionize the world economy.

Despite its high energy consumption, Bitcoin is still a more efficient way to send and receive money than the traditional financial system.

Will crypto destroy banks?

Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies have seen a surge in popularity in recent years, as investors look for alternatives to traditional currency and investment vehicles. The total value of all cryptocurrencies reached a peak of $813 billion in January 2018, but has since fallen to around $253 billion as of March 2019.

Many investors are bullish on cryptocurrency, believing that it will eventually replace traditional currency. However, there is also a faction of investors who believe that cryptocurrency will destroy the banking system.

The main argument of those who believe that cryptocurrency will destroy banks is that cryptocurrency is a more efficient and secure way of conducting transactions than traditional banking. Cryptocurrencies are not subject to government or financial institution control, meaning they can be used to avoid taxes, regulation, and bank fees. Transactions are also anonymous and secure, making them ideal for criminal activities such as money laundering and drug trafficking.

Banks are also facing competition from decentralized platforms such as Ripple and Ethereum, which allow for the conducting of transactions without the need for a third party. These platforms allow for the quick and easy transfer of money between countries, and could eventually replace traditional banking systems.

While it is possible that cryptocurrency could eventually replace banks, it is more likely that the two will coexist. Cryptocurrency has several advantages over traditional banking, but it also has several disadvantages. For example, cryptocurrency is still not widely accepted, meaning that it cannot be used to purchase goods and services. Cryptocurrency is also volatile, meaning that its value can fluctuate wildly from day to day.

Banks have been around for centuries, and it is likely that they will continue to exist for many years to come. Cryptocurrency has the potential to disrupt the banking system, but it is still in its early stages and has yet to reach its full potential.