Homestead Legal Life Estate8 min read

What is a Homestead Legal Life Estate?

A Homestead Legal Life Estate is a type of estate that allows the homeowner to live in the home for the rest of their life, and after they die, the home will be passed on to the designated heir. This type of estate is a great option for homeowners who want to ensure that their home will be passed on to their loved ones after they die, and it also provides peace of mind knowing that you will be able to live in your home until you die.

There are a few things to consider when creating a Homestead Legal Life Estate. The first is that you will need to designate an heir for the home. This can be a family member, friend, or even a charity. The second is that you will need to name an executor for the estate. This is the person who will be responsible for handling the estate after you die. The third is that you will need to create a will. This will outline your wishes for the home and estate after you die.

If you are considering creating a Homestead Legal Life Estate, it is important to consult with an estate planning attorney. They will be able to help you create the estate and will also provide advice on how to best protect your home and estate.

Table of Contents

Can you homestead a life estate in Florida?

Can you homestead a life estate in Florida?

Yes, you can homestead a life estate in Florida. A life estate is a form of ownership of real property in which the owner has the right to live in the property for the rest of his or her life, and after the owner’s death, the property passes to the person or persons the owner has designated in a will or trust. To homestead a life estate in Florida, you must own the property and reside in it as your primary residence.

What are the disadvantages of a life estate?

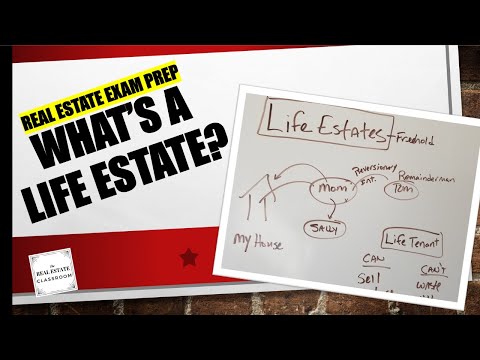

A life estate is a type of property ownership in which the owner (known as the life tenant) has the right to use and enjoy the property during their lifetime, with the remainder of the property going to another person or entity (known as the remainderman) when the life tenant dies. While a life estate can provide some benefits, it also has a number of potential disadvantages.

The biggest disadvantage of a life estate is that it can limit the life tenant’s ability to sell or otherwise dispose of the property. This is because, as the owner of the property, the life tenant is responsible for any liabilities associated with it, including any mortgages or liens. If the life tenant wants to sell the property, they will need the consent of the remainderman, and the sale may be subject to a higher price due to the liability risk.

A life estate can also create uncertainty about the future of the property. If the life tenant dies or becomes incapacitated, the remainderman will become the owner and may choose to sell the property or change its use. This can cause problems for the life tenant’s heirs, who may not be able to continue living in the property or may not be able to afford to buy it from the remainderman.

Finally, a life estate can be expensive to create and maintain. The life tenant will usually need to pay a fee to the remainderman in order to create or transfer the estate, and the property itself will need to be properly maintained in order to avoid any legal problems.

Is a life tenant the same as a life estate?

A life tenant is someone who holds an estate for their life, while a life estate is the property held by a life tenant.

The two are not exactly the same, as a life tenant can die and pass the estate on to someone else, whereas a life estate automatically ends when the person holding it dies.

However, the two are similar in that they allow the holder to use and enjoy the property for their lifetime, and they both give the holder a right to bequeath the property to someone else.

So, is a life tenant the same as a life estate? In some ways, yes, but in others, no. It really depends on the specific situation.

Which type of estate Cannot pass by inheritance?

Which type of estate Cannot pass by inheritance?

When someone dies, they will leave behind an estate. This estate is made up of all of their assets and liabilities. In many cases, the estate will be passed down to the deceased person’s heirs. However, there are some types of estates that cannot be passed down by inheritance.

One type of estate that cannot be passed down by inheritance is a trust estate. A trust estate is created when the deceased person’s assets are transferred to a trustee. The trustee will then manage and distribute the assets according to the wishes of the deceased person. If the deceased person did not leave any instructions, the trustee will distribute the assets according to the laws of the state.

A second type of estate that cannot be passed down by inheritance is a estate that is subject to a creditor’s claim. This type of estate is created when the deceased person has debts that are still unpaid at the time of their death. The estate will be used to pay off these debts. Any assets that are left over after the debts are paid will be passed down to the deceased person’s heirs.

A third type of estate that cannot be passed down by inheritance is a estate that is subject to a probate proceeding. A probate proceeding is a legal process that is used to settle the deceased person’s affairs. This process can take a long time and it can be expensive. As a result, many people choose to create a trust estate to avoid a probate proceeding.

A fourth type of estate that cannot be passed down by inheritance is a estate that is held in joint tenancy. A estate that is held in joint tenancy is owned by two or more people. When one of the owners dies, the estate will be passed down to the other owner or owners.

A fifth type of estate that cannot be passed down by inheritance is a estate that is owned by a single person. This type of estate will be passed down to the deceased person’s heirs.

Can someone with a life estate sell the property?

In general, a life estate is a legal device that allows a person to retain ownership of a property during their lifetime, after which the property ownership transfers to another party. So, the answer to the question posed in the title is “yes”, a person with a life estate can sell the property.

However, there are some specific things to be aware of when selling a life estate property. For example, the person with the life estate may be required to get the consent of the party who will inherit the property after their death. Additionally, the sale of a life estate property may be subject to gift or estate taxes.

If you are considering selling a life estate property, it is important to speak with an experienced estate planning attorney to discuss the potential implications of the sale.

Who pays the mortgage in a life estate in Florida?

In Florida, a life estate is a type of property ownership in which a person (the “life tenant”) has the right to use and enjoy a property during their lifetime, and a second person (the “remainderman”) has the right to own and possess the property after the life tenant’s death.

One of the key questions that often arises in connection with life estates is who is responsible for paying the mortgage on the property.

In general, the answer to this question depends on the terms of the life estate agreement. If the life estate agreement specifically provides that the life tenant is responsible for paying the mortgage, then the life tenant will be responsible for doing so. If the life estate agreement does not specify who is responsible for paying the mortgage, then the mortgage lender will likely look to the remainderman to pay the mortgage.

This issue can often be a source of conflict between the life tenant and the remainderman, particularly if the life tenant is unable to pay the mortgage. In such cases, the remainderman may be forced to sell the property in order to pay the mortgage.

If you are interested in creating a life estate in Florida, it is important to consult with an attorney to ensure that the agreement accurately reflects your intentions.

Who owns the property in a life estate?

In a life estate, the property is owned by the person who is alive at the time the estate is created. When that person dies, the property goes to the person or people named in the will or, if there is no will, to the person’s heirs according to state law.