Legal Life Estate Definition6 min read

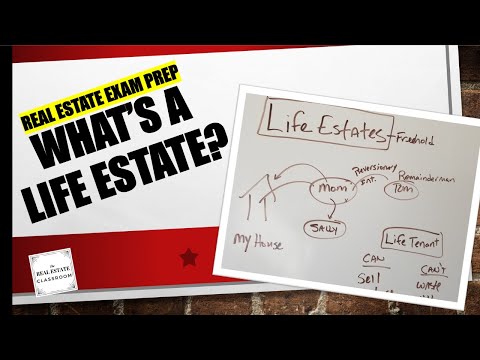

A legal life estate is a property interest that a person has in a property during their lifetime. The holder of a legal life estate has the right to use and occupy the property during their lifetime, and they also have the right to receive the income from the property. The holder of a legal life estate does not have the right to sell or give away the property, and when the holder of the legal life estate dies, the property passes to the person or organization that is named in the will or trust.

Table of Contents

What are the disadvantages of a life estate?

A life estate is a type of property ownership in which a person has the right to live in a property for the rest of their life, and after they die, the property goes to another person or entity. While life estates can be a great way to ensure that you always have a place to live, they also have a number of disadvantages.

One of the biggest disadvantages of a life estate is that you can’t sell the property. This can be a big issue if you need to move or if the property is no longer suitable for your needs. Additionally, if you want to make any changes to the property, such as remodeling or adding on, you’ll need to get permission from the person or entity who will inherit the property after you die.

Another disadvantage of a life estate is that you are responsible for all of the property taxes, maintenance, and repairs. This can be a big burden, especially if the property is large or expensive to maintain. Additionally, if you fail to pay the property taxes or maintain the property, the person or entity who inherits the property after you die can take legal action against you.

Finally, a life estate can be a risky investment. If the property goes up in value after you die, the person or entity who inherits the property can sell it and make a large profit. However, if the property value decreases after you die, the person or entity who inherits the property may not be able to sell it for as much as they paid for it, which could result in them losing money.

Is a life tenant the same as a life estate?

A life tenant is someone who holds an ownership interest in a property for their lifetime, while a life estate is the right to the use of a property for the rest of the owner’s life. They are similar in that the life tenant has the right to live in the property for the rest of their life, but there are some key differences.

A life tenant does not own the property outright – they only own the life estate, which is the right to use the property for the rest of their life. The life tenant cannot sell the property, or leave it to someone else in their will – the property will automatically go to the person who owns the property outright (the remainderman).

A life estate is the right to the use of a property for the rest of the owner’s life. The life estate holder can sell the property, or leave it to someone else in their will.

What is a life estate for dummies?

A life estate is a type of property ownership where a person (the “life tenant”) has the right to live in a property during their lifetime, and after they die the property is transferred to another person (the “remainderman”). The life estate can be created by a will or by a deed.

The life tenant has the right to use, occupy, and enjoy the property, but they don’t own it. They can’t sell it, give it away, or mortgage it. The remainderman is the person who owns the property after the life tenant dies.

A life estate is a type of property ownership, not a type of estate planning. It’s a way to transfer property ownership to someone else while still allowing the original owner to use it.

A life estate is a good option for someone who wants to leave property to someone else but still wants to be able to use it. For example, a parent might want to leave a house to their children, but they still want to be able to live in it until they die.

Who owns the property in a life estate?

Who owns the property in a life estate?

The person who created the life estate, called the “grantor,” retains ownership of the property during their lifetime. After the grantor’s death, the property passes to the person they named as the “life tenant.” The life tenant has the right to use and enjoy the property, but cannot sell it or give it away. If the life tenant dies, the property goes to the person they named as the “remainderman.”

How do I remove someone from my life estate?

There are a few ways to remove someone from your life estate. The most common way is to use a deed of distribution. This document will transfer the interest of the person you are trying to remove from the life estate to the other people who are still included in the estate. The other people in the estate will then become the new owners of the property.

Another way to remove someone from a life estate is by using a deed of partition. This document will split the property up among the different people who are included in the estate. This can be helpful if there are people in the estate who do not want to be involved with the person you are trying to remove.

Finally, you can also remove someone from a life estate by using a will. This will allow you to name someone else as the new owner of the property. This can be helpful if you do not want to use a deed of distribution or a deed of partition.

Can someone with a life estate sell the property?

Yes, a person with a life estate can sell the property. A life estate is a type of property ownership in which a person has the right to live in a property for the rest of their life, and after they die, the property goes to someone else. A person with a life estate can sell the property to anyone they want, and they can also name a beneficiary who will inherit the property after they die.

Can a life tenant surrender their interest?

The short answer is yes, a life tenant can surrender their interest, but there are some things to consider first.

When a life tenant surrenders their interest, they are essentially giving up their right to the property and any future income from it. This can be a good option for the life tenant if they no longer want or need the property, or if they would like to pass it on to someone else.

However, there are a few things to keep in mind before making this decision. First, the life tenant should consult with an attorney to make sure they are aware of all the implications of surrendering their interest. Second, the property must be sold or transferred to the new owner in a way that complies with the terms of the will or trust.

If you are a life tenant considering surrendering your interest, it is important to consult with an attorney to make sure you are aware of all the implications of this decision.