A Legal Life Estate9 min read

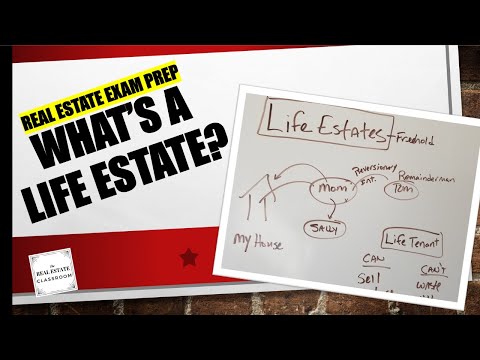

A legal life estate is a type of property ownership in which a person, the “grantor,” transfers ownership of a property to another person, the “grantee,” but retains the right to use and occupy the property for the remainder of his or her life. The grantor may also stipulate that the grantee must use the property for a specific purpose, such as to provide a home for the grantor, during the grantor’s lifetime. Upon the grantor’s death, the property passes to the grantee.

A legal life estate is a useful estate planning tool because it allows the grantor to retain some control over the property after it has been transferred to the grantee. The grantor can continue to live in the property, for example, or ensure that it is used for the grantor’s benefit. Additionally, a legal life estate can simplify the transfer of property after the grantor’s death, since the property passes directly to the grantee, rather than through the grantor’s estate.

A legal life estate can be created by executing a deed of conveyance or a will. The deed of conveyance must include the following elements:

– The names of the grantor and the grantee

– A description of the property

– The date of the transfer

The will must include the following elements:

– The name of the grantor

– The name of the grantee

– The date of the transfer

– The specific terms of the life estate

Table of Contents

How would you define a life estate?

A life estate is a type of property ownership in which a person, the life tenant, has the right to use and enjoy the property during their lifetime, and after their death the property reverts to the person who holds the property rights, known as the remainderman. The life tenant is not obligated to maintain the property, and the property does not have to be used for the life tenant’s residence.

What are the disadvantages of a life estate?

A life estate is a type of ownership in property where the owner has the right to live in the property for the rest of his or her life, and after the owner dies, the property goes to someone else. While there are some advantages to having a life estate, there are also some disadvantages to consider before deciding if this type of ownership is right for you.

The most obvious disadvantage of a life estate is that you do not have complete control over the property. You can’t sell it, give it away, or change the way it’s used without the consent of the person who will inherit it after you die. This can be a problem if you want to downsize and move to a smaller home, or if you need to make expensive repairs and don’t have the money to pay for them.

Another disadvantage of a life estate is that you are responsible for property taxes and maintenance costs, even if you are not living in the property. If you fall behind on your payments or can’t afford to fix the roof, the person who inherits the property after you die could be stuck with a lot of bills and repairs.

Finally, a life estate can create a lot of confusion and legal complications after the owner dies. If there is no clear plan for how the property should be distributed after the owner dies, it can lead to a lot of fighting and bickering among family members. This can be costly and time-consuming, and it can ruin relationships between family members.

Before deciding if a life estate is right for you, it’s important to consider all of the pros and cons carefully. Talk to a lawyer or financial advisor to get more advice specific to your situation.

Is a life tenant the same as a life estate?

A life tenant is someone who holds an estate for the duration of their life. A life estate is a type of property ownership where the holder has the right to use and possess the property during their lifetime, and after their death the property reverts to the original owner or their heirs.

The two terms are often used interchangeably, but technically a life tenant is the person who holds the property, while a life estate is the specific type of property ownership. In most cases, a life tenant is also the owner of the life estate. However, there are situations where the life estate can be held by someone other than the life tenant, such as a spouse or child.

The major difference between a life tenant and a life estate is that a life tenant can sell or give away their interest in the property, while the life estate holder cannot. This is because the life tenant technically doesn’t own the property, they only hold it for their lifetime.

There are a few things to consider before deciding whether a life tenant or life estate is right for you. First, you need to determine who the property will revert to after the life tenant’s death. If you want the property to go to a specific person or group, then you need to create a will or trust that designates the heir.

Second, you need to think about what will happen to the property if the life tenant dies before the original owner. In most cases, the property will go to the original owner or their heirs, but you need to make sure your arrangements are spelled out in your will or trust.

Finally, you should talk to an attorney to make sure you understand the tax consequences of a life tenant or life estate. In some cases, the estate may be eligible for a tax deduction, while in other cases the life tenant may have to pay taxes on the property.

What type of interest is a life estate?

A life estate is a type of estate that gives the owner the right to live in the property for the duration of their life. After the owner’s death, the property will pass to the designated heir. A life estate is a popular estate planning tool, as it allows the owner to live in the property for the rest of their life, while also ensuring that the property will pass to the designated heir after their death.

There are two types of life estates: the fee simple life estate and the term life estate. The fee simple life estate is the most common type of life estate, and it allows the owner to live in the property for the rest of their life, no matter how long that may be. The term life estate is a more limited type of life estate, which only allows the owner to live in the property for a specific period of time.

There are a few important things to note about life estates. First, the owner of a life estate has the right to sell, lease, or borrow against the property, just like any other owner. Second, the owner of a life estate is responsible for maintaining the property, and must pay all taxes and bills associated with it. Third, the owner of a life estate cannot will the property to someone other than the designated heir. Finally, if the owner of a life estate dies before the designated heir, the heir will automatically become the owner of the property.

Who owns the property in a life estate?

When someone creates a life estate, they are essentially giving someone else ownership of the property for the duration of that person’s life. This can be a great way to ensure that someone you care for will always have a place to live, and it can also provide some estate planning benefits.

However, who actually owns the property in a life estate? The answer to this question can vary, depending on the specific situation. In some cases, the person who creates the life estate will be the rightful owner of the property. In other cases, the person who receive the life estate will be the rightful owner.

There are a few factors that can influence who owns the property in a life estate. The most important factor is usually the wording of the life estate agreement. If the agreement is unclear or ambiguous, then the courts will have to decide who the rightful owner is.

Another important factor is the state law governing life estates. Some states will give the person who creates the life estate ownership of the property, while other states will give the person who receives the life estate ownership of the property.

It is also important to consider who the beneficiaries of the life estate are. If the life estate is passed down to someone else after the original owner dies, then that person will be the new owner of the property.

Ultimately, the answer to the question of who owns the property in a life estate will vary depending on the specific situation. If you are interested in creating a life estate, it is important to consult with an attorney to make sure you are aware of all the implications.

How do I remove someone from my life estate?

Removing someone from your life estate can be a difficult process, but it is possible. You will need to get a court order to have the person removed. There are several steps you will need to take in order to get the court order.

First, you will need to gather evidence that shows that the person is no longer part of your life estate. This evidence can include proof of residency, income, or assets. You will also need to provide evidence that the person is not contributing to your life estate in any way.

You will then need to file a petition with the court to have the person removed. The petition will need to include the evidence you have gathered, as well as a statement from you explaining why you want the person removed. The court will then review the evidence and make a decision.

If the court decides to remove the person from your life estate, they will issue a court order specifying the terms of the removal. This order will be binding on the person who is removed and all other members of your life estate.

Can someone with a life estate sell the property?

Yes, someone with a life estate can sell the property. A life estate is a legal interest in property that lasts for the life of the holder. It gives the holder the right to use and control the property during their life, and the right to receive the property’s proceeds when it’s sold.