Chase Quick Deposit Legal Agreement6 min read

Chase Quick Deposit is a legal agreement between you and Chase. It governs your use of Chase Quick Deposit. By using Chase Quick Deposit, you agree to be bound by this agreement.

The agreement includes the following terms:

– Your responsibilities as a Chase Quick Deposit user

– The types of transactions that are allowed with Chase Quick Deposit

– How to resolve disputes with Chase Quick Deposit

Your responsibilities as a Chase Quick Deposit user include:

– promptly notify Chase of any problems with Chase Quick Deposit

– maintain the security of your account and any passwords or other authentication information

– only use Chase Quick Deposit for authorized transactions

– not use Chase Quick Deposit to violate any law, statute, ordinance, or regulation

The types of transactions that are allowed with Chase Quick Deposit include:

– Depositing checks

– Receiving payments

– Withdrawing cash

How to resolve disputes with Chase Quick Deposit:

– If you have a dispute with Chase about a transaction, you should first contact Chase Quick Deposit Customer Service.

– If you are still not satisfied with the resolution, you may file a dispute with the Chase Ombudsman.

Table of Contents

Does Chase Bank Pay things trying to take money out your account?

Chase Bank is one of the largest banks in the United States. It’s no surprise that people have a lot of questions about it. One common question is whether or not Chase Bank pays things trying to take money out of your account.

The answer to this question is unfortunately, no. Chase Bank does not pay things that are trying to take money out of your account. If someone is trying to take money out of your account, it’s likely that they are trying to steal your money.

There are a few things you can do to protect yourself from this type of theft. First, make sure you have a strong password for your account. Also, be sure to monitor your account regularly for any unauthorized transactions. If you see any unauthorized transactions, be sure to report them to Chase Bank immediately.

Chase Bank is committed to protecting your account and your money. If you have any questions or concerns, be sure to contact Chase Bank customer service. They will be happy to help you.

Can I deposit someone else’s check into my Chase account?

Can I deposit someone else’s check into my Chase account?

Yes, you can deposit a check written to you by someone else into your Chase account. Just endorse the check with your name and account number and deposit it into an ATM or at a branch.

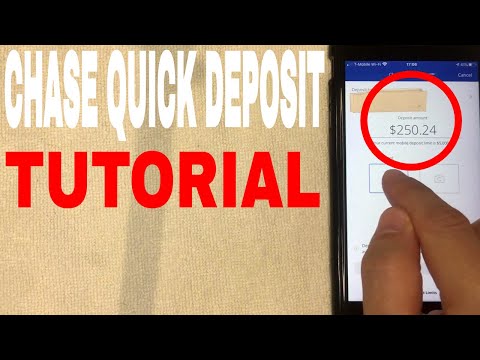

How does quick deposit from Chase work?

Chase quick deposit is a great way to make a deposit without having to go to the bank. You can use your phone or computer to make the deposit. You just need to have the routing number and account number for the account you are depositing into.

To make a quick deposit from your phone, you just need to download the Chase app and sign in. Then, tap on “Deposit Checks” and enter the amount you want to deposit. You will then be prompted to take a picture of the front and back of the check. Once the check is uploaded, you will receive a confirmation that the deposit was successful.

To make a quick deposit from your computer, you just need to sign in to your Chase account and go to the “Deposit Checks” tab. You will then be prompted to enter the amount you want to deposit and the check routing and account numbers. You will then be able to take a picture of the check or type in the information manually. Once the deposit is complete, you will receive a confirmation.

Does Chase deposit checks instantly?

Chase is one of the top banks in the United States, and many customers use its services for a variety of banking needs. One question that often comes up is whether or not Chase deposits checks instantly.

The answer to this question depends on a few factors. For example, the type of account that you have with Chase may affect how quickly your checks are deposited. In general, however, Chase does try to deposit checks as quickly as possible.

There are a few ways to check the status of a deposited check. You can either call or go online to your account and view the activity. This will show you when your check was deposited and when it was cleared.

If you’re looking for a more immediate update on your deposited check, you can also use the Chase mobile app. This app will give you a real-time update on the progress of your check.

Overall, Chase tries to make the check deposit process as quick and easy as possible for its customers. If you have any questions about how your check will be processed, be sure to speak to a Chase representative.

Do banks report ACH deposits to IRS?

ACH deposits are made when money is transferred electronically from one bank account to another. The deposits are usually made through direct deposits or wire transfers.

The question of whether or not banks report ACH deposits to the IRS has been a topic of debate for some time. There are a few schools of thought on the matter. The first belief is that banks do not report ACH deposits to the IRS. The second belief is that banks do report ACH deposits to the IRS, but only for large deposits that are over a certain dollar amount. The third belief is that banks do report ACH deposits to the IRS, and that the bank will report the name of the person who made the deposit, as well as the amount of the deposit.

There is no definitive answer to this question, as the answer may vary from bank to bank. It is important to check with your bank to find out their policy on reporting ACH deposits to the IRS. If you are concerned about whether or not your ACH deposits will be reported to the IRS, you may want to consider making smaller deposits, or using a different method of transferring money to your bank account.

What happens if my Chase account is negative for too long?

If you have a Chase account that is negative for too long, the bank will likely close it.

Chase account holders are allowed to have a negative balance for a certain amount of time, but if that negative balance persists for too long, the bank will close the account.

There are a few things account holders can do to avoid having their Chase account closed for having a negative balance.

One is to make a payment on the account as soon as possible. Another is to make sure that the account is not overdrawn for too long.

Chase account holders who have a negative balance should also keep in mind that the bank may charge them overdraft fees.

If an account is close because of a negative balance, the account holder may be able to reopen it, but they may have to pay a fee.

Can I deposit a check that’s not in my name?

Can I deposit a check that’s not in my name?

In most cases, you cannot deposit a check that is not in your name. However, there are a few exceptions. If you are a joint account holder on the check, you may be able to deposit it into your account. Additionally, if you are authorized on the check, you may be able to deposit it into your account. If you are not authorized on the check, or are not a joint account holder, you will not be able to deposit the check.