Fiduciary Duty Legal Definition8 min read

A fiduciary duty is a legal obligation to act in the best interests of another person or entity. The party owing the fiduciary duty is known as the fiduciary, while the person or entity to whom the duty is owed is known as the beneficiary.

A fiduciary duty arises out of a relationship of trust and confidence between the fiduciary and the beneficiary. The fiduciary must put the interests of the beneficiary above his own interests, and must not take advantage of the beneficiary in any way.

The law imposes a fiduciary duty on a wide range of professionals, including attorneys, accountants, and financial advisors. The fiduciary duty applies not only to the professional’s dealings with the beneficiary, but also to the professional’s dealings with the beneficiary’s money and property.

A breach of fiduciary duty can lead to a lawsuit by the beneficiary. The fiduciary may be required to pay damages to the beneficiary, as well as disgorge any profits he has made as a result of the breach.

Table of Contents

What are the 3 fiduciary duties?

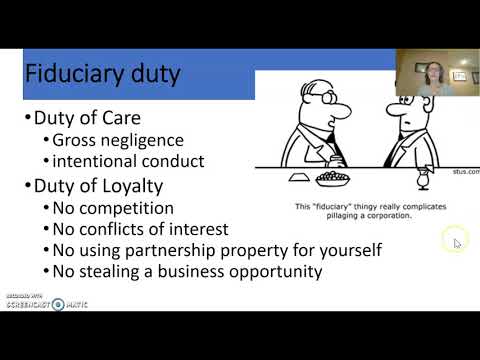

There are three fiduciary duties owed by a trustee: the duty of care, the duty of loyalty, and the duty of obedience.

The duty of care requires the trustee to act prudently and in the best interests of the beneficiaries. This includes making informed decisions and exercising reasonable judgment.

The duty of loyalty requires the trustee to put the interests of the beneficiaries above their own interests. This includes avoiding any conflicts of interest and acting impartially.

The duty of obedience requires the trustee to comply with the terms of the trust and the laws governing trusts.

What are some examples of fiduciary duty?

A fiduciary duty is a legal obligation to act in the best interests of another person or organization. This duty arises out of a relationship of trust and confidence. Fiduciaries are typically appointed to positions of trust, such as in the case of a corporate director, an attorney, a trustee, or a guardian.

There are a number of specific examples of fiduciary duty. Corporate directors have a fiduciary duty to act in the best interests of the company, to maximize profits for shareholders, and to avoid conflicts of interest. Attorneys have a fiduciary duty to their clients to provide competent representation and to keep information confidential. Trustees have a fiduciary duty to administer trust property for the benefit of the beneficiaries. Guardians have a fiduciary duty to protect the interests of their wards.

Breach of fiduciary duty is a common cause of legal action. When a fiduciary fails to live up to their obligations, they can be held liable for any damages that result. This can include losses suffered by the person or organization they are supposed to be serving, as well as any legal costs or penalties that may be imposed.

Fiduciary duty is a critical part of many legal relationships. When parties can be confident that the person they are dealing with is obligated to act in their best interests, it helps to ensure that the transaction will be fair and honest.

Is fiduciary duty a legal obligation?

The term “fiduciary duty” is often used in the legal field, but what does it actually mean? In general, a fiduciary duty is a legal obligation to act in the best interests of another party. This duty arises in a variety of situations, but is most commonly seen in the context of trust and estate law.

When someone holds a fiduciary duty, they are required to put the interests of the person or entity they are representing above their own. This includes making decisions that are in the best interests of the other party, even if it is not what the fiduciary would want for themselves.

There are a few key factors that contribute to the existence of a fiduciary duty. First, the relationship between the parties must be one of trust and confidence. This means that the person who owes the fiduciary duty must be able to rely on the other party to act in good faith.

Second, the fiduciary must be in a position of power or influence over the other party. This power can come from a number of sources, such as a position of authority or a position of trust.

Finally, the fiduciary must exercise their power in a way that benefits the other party. This includes making decisions that are in the best interests of the other party, and not simply using their power for their own benefit.

There are a few key things to keep in mind when considering a fiduciary duty. First, the fiduciary duty is not absolute. The fiduciary can still make decisions that are not in the best interests of the other party, as long as they are acting in good faith and have a reasonable basis for doing so.

Second, the fiduciary duty does not always require the fiduciary to take action. The fiduciary can choose to not take action if they believe that it is not in the best interests of the other party.

Finally, the fiduciary duty is not always permanent. The fiduciary can end the relationship at any time, as long as they act in good faith and provide notice to the other party.

So, is fiduciary duty a legal obligation? In short, yes. Fiduciary duties are a key part of many legal relationships, and those who owe a fiduciary duty are required to act in the best interests of the other party.

What is a fiduciary in simple terms?

A fiduciary is a person who has a legal duty to act in the best interests of another person or organization. This could include a trustee who manages money or property for a beneficiary, or a guardian who is responsible for the care of a minor or an incapacitated person.

In some cases, a fiduciary may also have a duty to disclose any potential conflicts of interest to the person or organization they are serving. For example, a financial advisor who is also a shareholder of a company they are recommending investing in may need to disclose this fact to their clients.

Fiduciaries are held to a high legal standard, and are required to put the interests of their clients or beneficiaries above their own. They can be held liable for any losses that occur as a result of their actions, so it is important that they always act in good faith and in the best interests of their clients.

What constitutes a breach of fiduciary duty?

A fiduciary duty is a legal obligation to act in the best interests of another person or entity. Fiduciaries are held to a high standard of care, and a breach of fiduciary duty can result in legal action.

There are several things that can constitute a breach of fiduciary duty. Fiduciaries can breach their duty by failing to act in the best interests of their clients, by neglecting their clients’ interests, by misusing their clients’ money or information, or by engaging in self-dealing.

Fiduciaries who breach their duty can be held liable for damages. Victims of fiduciary abuse can file a lawsuit to recover their losses.

Who owes a fiduciary duty?

A fiduciary duty is a legal obligation to act in the best interests of another party. It applies in a wide range of situations, including when one person is charged with managing the money or property of another, when two people are in a relationship of trust, or when an attorney is representing a client.

The person who owes the fiduciary duty is known as the fiduciary, while the person who is owed the duty is known as the beneficiary. The fiduciary is typically required to disclose any potential conflicts of interest, and must avoid any actions that could benefit themselves at the expense of the beneficiary.

There is a wide range of situations in which a fiduciary duty may be owed. Some of the most common are:

• Managers of company money or property

• Trustees of a trust

• Attorneys representing clients

• Agents acting on behalf of principals

The key thing to remember is that a fiduciary duty is always owed to someone else, and must be carried out in their best interests.

How do I prove fiduciary duty?

When it comes to proving fiduciary duty, it can be tricky. Generally, you need to be able to show that there was a relationship between the parties in which one party had a duty to act in the best interests of the other. This can be done by looking at factors such as the level of trust between the parties, the nature of the relationship, and the amount of control one party had over the other.

If you are trying to prove fiduciary duty, it is important to have evidence to support your case. This evidence can come in the form of emails, text messages, financial records, or any other documentation that supports your claim. It is also important to be prepared to testify in court if necessary.

If you are facing a situation in which you believe someone has breached their fiduciary duty, it is important to seek legal advice. A lawyer can help you determine whether you have a case, and can help you take the appropriate steps to protect your interests.