Judicial Foreclosure In California6 min read

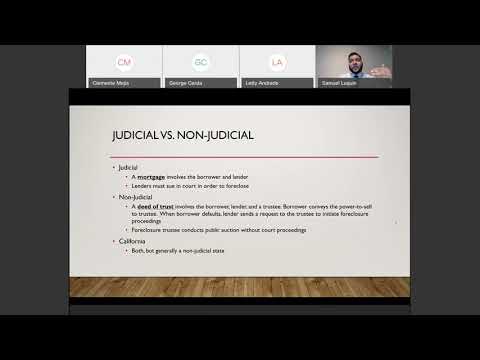

A foreclosure is a legal process by which a lender, typically a bank, obtains title to a property when the property’s owner fails to make a loan payment. In California, there are two types of foreclosure: judicial and non-judicial.

A judicial foreclosure is a process in which the lender files a lawsuit in court to obtain a judgment against the borrower. This type of foreclosure is used when the property is owned by a person or company and the loan is secured by a mortgage or deed of trust.

The lender must first file a lawsuit in court and obtain a judgment against the borrower. Once the judgment is obtained, the lender can then sell the property at a public auction. The borrower has the right to contest the foreclosure in court, but if the borrower fails to do so, the property will be sold at auction.

A non-judicial foreclosure is a process in which the lender does not have to file a lawsuit in court. This type of foreclosure is used when the property is owned by a person or company and the loan is not secured by a mortgage or deed of trust.

The lender can sell the property at a public auction without having to go to court. The borrower does not have the right to contest the foreclosure.

Table of Contents

How long does a judicial foreclosure take in California?

How long does a judicial foreclosure take in California?

Under the California Civil Code, the time period for a judicial foreclosure is four months and twenty days. This is from the time the notice of default is filed until the property is sold at auction. If the property is sold at auction and the winning bidder does not close on the property, the foreclosure process begins again.

What are the two types of foreclosures in California?

There are two types of foreclosures that can take place in California: judicial and non-judicial.

Judicial foreclosure is the most common type of foreclosure in California. This type of foreclosure happens when the lender files a lawsuit against the borrower in order to foreclose on the property. The lender is seeking a judicial decree from the court in order to sell the property to satisfy the outstanding debt.

Non-judicial foreclosure is a less common type of foreclosure in California. This type of foreclosure happens when the lender takes back the property through a trustee sale without going to court. This type of foreclosure is usually used when the property is secured by a deed of trust.

What is the foreclosure process in California?

The foreclosure process in California generally follows a specific pattern, although there are variations depending on the lender. The typical steps are as follows:

1. The lender sends a notice of default to the borrower.

2. The borrower has a chance to cure the default by bringing the loan current.

3. If the borrower does not cure the default, the lender may initiate foreclosure proceedings.

4. The lender may sell the property at a public auction or through a private sale.

5. The lender may also pursue a deficiency judgment against the borrower.

The foreclosure process can be lengthy and complex, so it is important to seek legal assistance if you are facing foreclosure.

What kind of redemption is available for judicial foreclosure?

When a homeowner falls behind on their mortgage payments, the lender has a few options for how to proceed. One option is judicial foreclosure, which is a process through the court system.

During judicial foreclosure, the lender files a lawsuit against the borrower and requests that the court order the sale of the property to pay off the mortgage debt. The borrower then has a certain amount of time to redeem the property, or buy it back, from the purchaser at the sale.

The type of redemption available depends on the state where the property is located. Most states offer a redemption period of between three and six months, but the specific time period may vary.

The redemption amount is also set by state law. In most cases, the redemption amount is the total amount of debt owed on the property, plus interest and any costs incurred by the lender in the foreclosure process.

However, a few states have different redemption laws. In Texas, for example, the redemption amount is the amount of debt owed on the property, minus any costs incurred by the lender.

Homeowners who are facing foreclosure should speak with an attorney to learn more about the redemption process in their state and what kind of redemption is available.

How much does it cost to foreclose on a property in California?

In California, it costs an average of $279 to foreclose on a property. This includes the costs of filing the initial notice of default, preparing and recording the notice of sale, and conducting the sale itself.

The specific costs that are incurred vary depending on the county in which the property is located. For example, the filing fee may be $225 in one county, but $275 in another.

In addition to the direct costs of foreclosure, there are also a number of indirect costs which can add up. These include lost rent, missed mortgage payments, and legal and administrative costs.

If you are facing foreclosure, it is important to seek legal advice as soon as possible. A qualified attorney can help you understand your rights and options, and may be able to negotiate with your lender on your behalf.

Is California a judicial or nonjudicial state?

In the eyes of the federal government, California is a judicial state. This means that the federal government believes that the state’s judiciary has the power to interpret and apply the law.

However, many people in California believe that the state is actually a nonjudicial state. This is because the state’s Constitution does not explicitly give the judiciary the power to interpret and apply the law. Instead, the Constitution gives this power to the legislature.

As a result, the California Supreme Court has had to make a number of decisions over the years to determine whether the judiciary or the legislature has the power to interpret and apply the law. These decisions have been controversial, and have led to a lot of tension between the judiciary and the legislature.

Ultimately, it is up to the people of California to decide whether they want the judiciary or the legislature to interpret and apply the law.

How do I evict a former owner after foreclosure in California?

In California, a former owner who remains on the property after a foreclosure can be evicted. The eviction process begins by serving the former owner with a three-day notice to vacate. If the former owner does not leave, the eviction process can continue with a summons and complaint. The former owner can file a response to the complaint, but if the court finds that the former owner is trespassing, the former owner can be ordered to leave the property.