Legal Amount On Check5 min read

When you write a check, you need to include the amount in both words and numbers. The amount in words is the legal amount on the check. This is the amount that the bank is required to pay if the check is cashed. The amount in numbers is the amount that you are actually writing on the check. The bank may pay more or less than the legal amount, depending on the check’s condition.

Table of Contents

Is there a limit on the amount I can write a check for?

Is there a limit on the amount I can write a check for?

The amount that can be written on a check is limited to $9,999.99. Anything over this amount must be written in a money order or wire transfer. There are no regulations on the number of checks that can be written per day, but there is a limit of $2,000 per check.

Is a check valid without a numerical amount?

A check is a negotiable instrument that is used as a form of payment. Checks can be used to pay for goods or services, or they can be used to transfer money from one account to another. Checks are typically written out by the person who owes the money, and the person who is to receive the money typically deposits the check into their bank account.

There are a few things that you should know about checks before you try to use them. One of these things is that a check must have a numerical amount written on it. This is the amount of money that the check is for. If you do not include a numerical amount on the check, it will not be valid.

It is important to note that a check can still be used if you do not include a numerical amount on it. In this case, the check will be considered to be for a certain amount of money, which is typically the amount that is written in the “Memo” line on the check. This is the line where you would write out the specific details of the transaction, such as the date, the name of the person you are paying, and the amount of money that is being paid.

If you are not sure how to write a check, or if you need help figuring out the amount that needs to be written on the check, you can consult with your bank. They will be able to help you with the process and answer any questions that you may have.

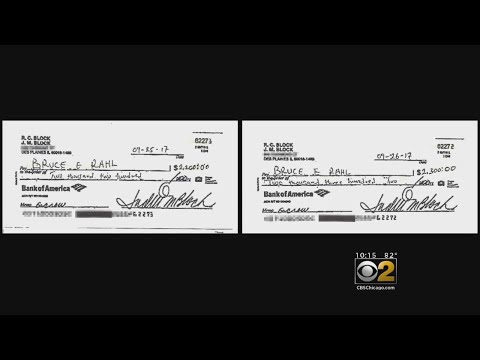

What happens if the numerical amount and the written amount on a check are not the same?

When you write a check, the numerical amount and the written amount should be the same. If they’re not, there can be problems.

The most obvious problem is that the check might not be paid. The bank might not be able to read the written amount, and might not be able to tell that it’s a check. This could lead to the check being deposited and not cleared, or even cashed and not paid.

There are other potential problems as well. For instance, the bank might charge you a fee for writing a check with a discrepancy. Or, if you’re trying to write a check for more than the amount you have in your account, the bank might refuse to process the check.

So, if you’re ever in doubt about the amount you should write on a check, it’s always best to go with the numerical amount. That way, you’ll avoid any potential problems.

What happens if check amount is wrong?

If you mistakenly write a check for more money than you have in your account, the bank may cover the overage. However, if you have insufficient funds in your account to cover the check, the bank may charge you a fee for the bounced check, and you may also face a returned check fee from the merchant. In some cases, the bank may even report the bounced check to a credit bureau, which could damage your credit score.

What happens when you deposit a check over $10000?

When you deposit a check over $10000, the bank will likely scrutinize the check more carefully to ensure that it is valid. This is because large checks tend to be more likely to be fraudulent. If the bank determines that the check is not valid, it may refuse to deposit the check or may deposit it but then later ask the customer to cover the amount of the check.

How do you write a check for $25000?

When you need to write a check for a large amount of money, it’s important to make sure that the numbers are written correctly. Here’s how to write a check for $25,000:

1. Write the amount of the check in the appropriate box. In this case, you would write “25000” in the box labeled “Dollars.”

2. Write the word “Dollars” after the amount of the check.

3. Write the name of the person or company who will be receiving the payment.

4. Sign the check.

5. Write the name of the bank where the check is drawn.

6. Write the routing number and account number for the bank.

Does the written amount on a check matter?

When you write a check, the amount you write is the amount that will be transferred from your account to the recipient’s account. This is true regardless of the actual amount of the check. For example, if you write a check for $100, but the actual amount of the check is $120, the recipient will still receive $100.

There are a few situations in which the written amount on a check can matter. One is when a check is used to make a payment on a loan. In this case, the lender may use the amount on the check to calculate the interest that is owed. Another situation in which the written amount on a check can matter is when a check is used as collateral for a loan. In this case, the lender may use the amount on the check to determine the value of the loan.