Legal Definition Of Fiduciary6 min read

A fiduciary is a legal term that refers to a person who is in a position of trust with respect to another person or persons. The fiduciary is typically responsible for managing the finances or property of the person or persons who have placed their trust in them.

There are a number of different types of fiduciaries, including but not limited to:

-A trustee, who is responsible for the management of property held in trust

-A guardian, who is responsible for the care of a minor or an incapacitated adult

-A power of attorney, who is given authority to act on behalf of another person

The definition of fiduciary can vary from state to state, but generally, a fiduciary is someone who owes a duty of loyalty and care to the person or persons who have placed their trust in them. This duty of loyalty and care requires the fiduciary to act in the best interests of their clients at all times, and to avoid any conflicts of interest.

If you are considering hiring a fiduciary to manage your finances or property, it is important to understand the duties and obligations that they will be expected to uphold. It is also important to ask any potential fiduciaries about any potential conflicts of interest that they may have.

Table of Contents

Who is considered a fiduciary?

A fiduciary is a person or organization who owes a duty of trust to another party. The fiduciary is required to act in the best interests of the other party, and must disclose any potential conflicts of interest.

The most common example of a fiduciary relationship is between a trustee and a beneficiary. The trustee is responsible for managing the assets of the beneficiary, and must always act in the best interests of the beneficiary.

Other examples of fiduciaries include attorneys, accountants, and investment advisors. These professionals owe a duty of loyalty and confidentiality to their clients, and must always act in the best interests of their clients.

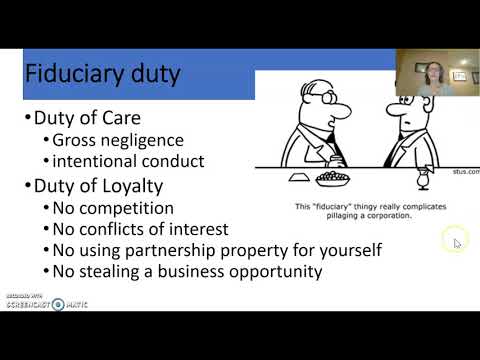

What are the 3 fiduciary duties?

There are three main fiduciary duties that a trustee has to a beneficiary: the duty of care, the duty of loyalty, and the duty of obedience.

The duty of care requires the trustee to exercise reasonable care in their management of the trust and its assets. They must act in the best interests of the beneficiary and not for their own personal gain.

The duty of loyalty requires the trustee to put the interests of the beneficiary first and avoid any conflicts of interest.

The duty of obedience requires the trustee to follow the instructions of the beneficiary as set out in the trust document.

If a trustee fails to discharge their fiduciary duties, they may be held liable for any losses suffered by the beneficiary.

What constitutes a breach of fiduciary duty?

A fiduciary duty is a legal obligation to act in the best interests of another person or entity. A breach of fiduciary duty occurs when a fiduciary fails to meet this obligation.

There are a number of factors that can constitute a breach of fiduciary duty. These include:

– Failing to act in the best interests of the beneficiary

– Acting in a self-interested manner

– Failing to disclose material information

– Misusing entrusted funds or assets

If you believe that your fiduciary has breached their duty, you may want to consult with an attorney to discuss your options.

What are the 5 fiduciary duties?

A fiduciary is a person who owes a duty of trust to another person. When you act as a fiduciary, you must always put the interests of your beneficiary ahead of your own.

There are five fiduciary duties that all fiduciaries must adhere to: duty of loyalty, duty of care, duty of good faith, duty of disclosure, and the duty to avoid conflicts of interest.

The duty of loyalty requires fiduciaries to act in the best interests of their beneficiaries at all times. This includes avoiding any conflict of interest that may arise.

The duty of care requires fiduciaries to exercise due diligence when making decisions on behalf of their beneficiaries. This includes making informed decisions and considering all relevant factors.

The duty of good faith requires fiduciaries to always act in good faith when making decisions on behalf of their beneficiaries. This includes being honest and fair, and not taking advantage of their position.

The duty of disclosure requires fiduciaries to disclose all material information to their beneficiaries. This includes any information that could reasonably impact their decision-making.

The duty to avoid conflicts of interest requires fiduciaries to avoid any situation that could benefit themselves at the expense of their beneficiaries. This includes taking steps to ensure that their personal interests do not come into conflict with their fiduciary duties.

What are the requirements of a fiduciary?

A fiduciary is a person who owes a duty of trust to another party. The requirements of a fiduciary vary depending on the context, but typically include duties of loyalty, care, and good faith. Fiduciaries are often entrusted with managing money or other assets on behalf of another person or entity.

In order to meet the duties of loyalty and care, a fiduciary must act in the best interests of the party they are entrusted with. This means making decisions that are not tainted by self-interest, and taking into account the needs of the party they are representing. A fiduciary must also act with good faith, meaning they must not take advantage of their position or mislead the party they are representing.

Fiduciaries are typically held to a high standard of accountability, and can be held liable for any losses that result from their actions. In some cases, they may even be required to repay any profits they make from their position.

The requirements of a fiduciary can vary depending on the context, but typically include duties of loyalty, care, and good faith. Fiduciaries are often entrusted with managing money or other assets on behalf of another person or entity. In order to meet the duties of loyalty and care, a fiduciary must act in the best interests of the party they are entrusted with, making decisions that are not tainted by self-interest, and taking into account the needs of the party they are representing. A fiduciary must also act with good faith, meaning they must not take advantage of their position or mislead the party they are representing. Fiduciaries are typically held to a high standard of accountability and can be held liable for any losses that result from their actions. In some cases, they may even be required to repay any profits they make from their position.

Which of the following is not considered a fiduciary?

There are many different types of fiduciaries, but which of the following is not considered a fiduciary?

A trustee is a fiduciary, as are many other professionals such as attorneys, accountants, and financial advisors. However, a broker is not a fiduciary. A broker is someone who arranges transactions between a buyer and a seller, but is not responsible for the advice they give.

So which of the following is not considered a fiduciary? A broker.

What is another word for fiduciary?

A fiduciary is a person who is entrusted with the responsibility of acting in the best interest of another person. This can include managing money or property, or providing advice. Fiduciaries are legally bound to act in the best interests of their clients, and can be held liable if they do not.