Legal Document For Loan Agreement6 min read

A loan agreement is a contract between a borrower and a lender, whereby the borrower agrees to repay a loan in installments over a predetermined period of time. A loan agreement outlines the specific details of the loan, including the interest rate, the monthly payments, and the consequences of default.

Loan agreements are generally drafted by lawyers and are very specific to the individual loan transaction. As such, it is important to consult with a lawyer before entering into a loan agreement to ensure that all the terms and conditions are fully understood.

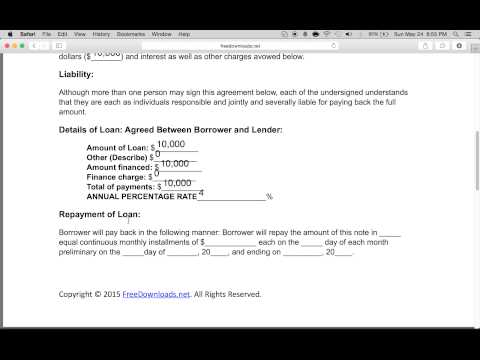

Some of the key terms and conditions that should be included in a loan agreement include:

– The amount of the loan

– The interest rate

– The monthly payment amount

– The term of the loan

– The consequences of default

– The lender’s rights in the event of default

– The borrower’s rights in the event of default

It is also important to understand that a loan agreement is a legally binding contract, and if the borrower fails to make the required payments, the lender may take legal action to recover the outstanding debt.

Table of Contents

How do I write a legal loan agreement?

A loan agreement is a document that outlines the terms and conditions of a loan. It is important to have a loan agreement in place when borrowing money, as it can help to protect both the borrower and the lender.

When writing a loan agreement, it is important to include the following information:

-The name of the borrower and lender

-The amount of the loan

-The interest rate

-The repayment schedule

-The consequences of defaulting on the loan

-The conditions under which the loan can be renegotiated

It is also important to include any special conditions that may apply, such as the need for the borrower to provide security for the loan.

Both the borrower and lender should sign the loan agreement, and it should be kept in a safe place.

Is a loan agreement a legal document?

A loan agreement is a legal document that sets out the terms and conditions of a loan. It is a contract between the lender and the borrower.

The loan agreement will include the amount of the loan, the interest rate, the repayment schedule and any other terms and conditions. It is important to make sure that the loan agreement is clear and concise, and that both parties understand and agree to the terms.

If the loan agreement is not honoured by either party, the agreement may be subject to legal action.

What is a legal loan agreement?

What is a legal loan agreement?

A legal loan agreement is a contract between a lender and a borrower that outlines the terms and conditions of the loan. The agreement includes information such as the amount of the loan, the interest rate, the repayment schedule, and the consequences of late or missed payments.

A legal loan agreement is important because it helps protect both the lender and the borrower. The agreement can help ensure that the terms of the loan are clear and that both parties understand their obligations. It can also help prevent misunderstandings and disputes down the road.

If you’re thinking of taking out a loan, it’s important to understand the terms of the agreement and to make sure the agreement is in writing. If you have any questions, be sure to talk to a lawyer.

What should be included in a loan agreement?

A loan agreement is a written contract between a lender and a borrower. It lays out the terms of the loan, including the amount of money borrowed, the interest rate, and the repayment schedule.

A loan agreement should include the following information:

-The name and contact information of the lender and borrower

-The amount of money being borrowed

-The interest rate

-The repayment schedule

-The consequences of defaulting on the loan

-Any other terms and conditions of the loan

Does loan agreement need to be registered?

When two or more people enter into an agreement to borrow or lend money, is that agreement legally binding? And if so, does it need to be registered with any government authority?

The answer to both of these questions is yes. A loan agreement is a legally binding contract, and it must be registered with the relevant government authority in order to be enforceable.

The reason for this is to protect the interests of both the lender and the borrower. By registering the agreement, both parties can be sure that the terms of the loan are clear and that there is a record of the agreement in case of any disputes.

It is important to note that not all loans need to be registered. For example, a loan between friends or family members does not need to be registered, as there is a presumption of trust between these parties. However, any other type of loan should be registered.

If you are considering taking out a loan, it is important to make sure that you understand the terms and conditions of the loan agreement. And if you are thinking of lending money, you should also make sure that the agreement is registered in order to protect your interests.

Should loan agreement be notarized?

When two or more people enter into a loan agreement, is it necessary to have the agreement notarized?

The answer to this question depends on the state in which the agreement is made. In some states, notarization is not required, while in others it is. It is important to check with an attorney in your state to find out whether notarization is necessary in order for the agreement to be legally binding.

If notarization is not required in your state, there may still be some benefits to having the agreement notarized. Notarization can serve as a form of authentication, and it can also help to prevent disputes from arising later on. If there is a dispute about the terms of the loan agreement, having it notarized can help to provide evidence that the agreement was, in fact, entered into by the parties involved.

If you decide to have your loan agreement notarized, it is important to make sure that you choose a notary public who is qualified to notarize loan agreements. Not all notaries public are qualified to do this, so be sure to ask before you have the agreement notarized.

Is promissory note a loan agreement?

Is promissory note a loan agreement?

A promissory note is a written agreement between a lender and a borrower that outlines the terms of a loan. It can be used to document a loan between friends or family members, or it can be used to formalize a loan agreement between two businesses.

A promissory note typically contains the following information:

• The name of the lender and the borrower

• The amount of the loan

• The date the loan is to be repaid

• The interest rate

• The repayment schedule

A promissory note is not a loan agreement. A loan agreement is a legal document that outlines the terms of a loan between two businesses. A promissory note is a document that memorializes the terms of a loan that has already been agreed to.