Legal Document For Loaning Money7 min read

A legal document for loaning money is a document that outlines the terms and conditions of a loan between two parties. This document can be used to protect both the lender and the borrower in the event of a dispute.

A legal document for loaning money typically includes the following information:

-The name and contact information of both the lender and the borrower

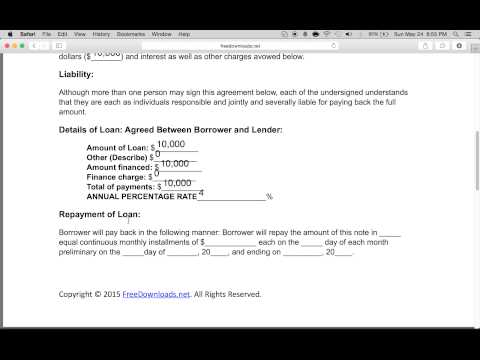

-The amount of the loan

-The interest rate

-The repayment schedule

-The consequences of defaulting on the loan

-The jurisdiction governing the loan

Both the lender and the borrower should review and sign the legal document for loaning money prior to the loan being disbursed. This document can help to ensure that both parties are aware of their legal rights and responsibilities.

Table of Contents

How do you write a legal contract for lending money?

When lending money to another person, it’s important to have a legal contract in place that outlines the terms of the loan. This document can help to protect both the lender and the borrower in the event of a dispute.

There are a few key things to include in a loan contract:

1. The amount of money being borrowed, and the interest rate

2. The repayment schedule, including when and how the loan will be repaid

3. The consequences if the borrower fails to repay the loan

4. The rights and responsibilities of the lender and the borrower

5. Any other terms and conditions that are important to both parties

If you’re not sure what to include in your loan contract, it’s best to consult with a lawyer. They can help you to create a document that is fair and legally binding for both parties.

How do I write a personal loan agreement?

When you borrow money from a friend or family member, it’s important to have a written agreement in place. This document will outline the terms of the loan, including the amount of money that is being borrowed, the interest rate, and when the loan will be repaid.

Here are the steps to creating a personal loan agreement:

1. Decide on the terms of the loan. This includes the amount of money that is being borrowed, the interest rate, and the repayment schedule.

2. Write out the agreement. This can be done in a simple document, or you can use a legal form.

3. Have both parties sign the agreement.

4. Make sure to keep a copy of the agreement for your records.

The personal loan agreement should be fair to both parties. The interest rate should be reasonable, and the repayment schedule should be manageable for the borrower. If you’re unable to repay the loan according to the agreed-upon schedule, be sure to renegotiate the terms of the agreement.

It’s also a good idea to have a written agreement in place if you’re lending money to someone. This will protect you in the event that the borrower fails to repay the loan.

A personal loan agreement is an important document that should be used when borrowing or lending money. By following these simple steps, you can create a fair and equitable agreement that will be beneficial to both parties involved.

What makes a loan agreement legal?

A loan agreement is a document that outlines the terms and conditions of a loan. It is a legal contract between the borrower and the lender, and it is important that the terms of the agreement are followed closely.

There are a few things that make a loan agreement legal. Firstly, the agreement must be entered into willingly by both parties. Secondly, the agreement must be in writing, and both the borrower and the lender must sign it. Finally, the agreement must include all of the important details about the loan, including the amount of the loan, the interest rate, the repayment schedule, and the consequences of defaulting on the loan.

If all of these requirements are met, the loan agreement will be legally binding and the lender can pursue legal action if the borrower fails to repay the loan according to the terms of the agreement.

What is a simple loan agreement?

What is a loan agreement?

A loan agreement is a legal document between a lender and a borrower that outlines the terms and conditions of a loan. Generally, a loan agreement will include the following information:

The name of the lender and the borrower

The amount of the loan

The interest rate

The repayment schedule

The consequences of defaulting on the loan

A loan agreement should be drafted by a lawyer and it is important to understand all the terms and conditions before signing.

How do you write a simple loan note?

A loan note is a document that records a loan agreement between two parties. In most cases, a loan note will include the following information:

The name and contact information of the borrower

The name and contact information of the lender

The amount of the loan

The date of the loan

The interest rate on the loan

The terms of the loan

The repayment schedule

When drafting a loan note, it is important to include all of the pertinent information in a clear and concise manner. The loan note should be easy to understand, and the terms should be fair and reasonable for both parties.

If you are considering taking out a loan, be sure to review the loan note carefully to make sure you understand the terms and conditions. If you have any questions, be sure to ask the lender for clarification.

Does loan agreement need to be registered?

When two or more individuals enter into a loan agreement, it is typically a good idea to have the agreement registered with a third party. This serves as proof of the agreement in the event that one of the parties fails to comply with its terms.

While it is not mandatory to have a loan agreement registered, it is a good idea to do so. This will help to ensure that both parties are aware of their responsibilities and obligations under the loan agreement.

If you are considering entering into a loan agreement with someone, it is a good idea to speak to a lawyer to ensure that the agreement is drafted correctly. This will help to protect you in the event that something goes wrong.

Does a personal loan agreement need to be notarized?

When you borrow money from a friend or family member, you may not think to have a formal agreement in place. But if you’re looking to take out a personal loan from a financial institution, you will likely be required to have a notarized loan agreement.

What is a notarized loan agreement?

A notarized loan agreement is a document that has been notarized by a notary public. This means that the notary has verified the identity of the borrower and the lender, and has witnessed the signing of the agreement.

Why is a notarized loan agreement necessary?

A notarized loan agreement is necessary for a number of reasons. First, it ensures that both the borrower and the lender are aware of the terms of the loan. It also helps to protect both parties in the event of a dispute. And finally, it provides legal proof that the loan agreement was entered into willingly by both parties.

Can a loan agreement be notarized after it’s been signed?

Yes, a loan agreement can be notarized after it’s been signed. However, it’s important to note that the notary cannot change the terms of the agreement. If any changes are made to the agreement, it must be re-signed by both the borrower and the lender and notarized again.

Are there any other reasons why a loan agreement might need to be notarized?

There are a few other reasons why a loan agreement might need to be notarized. For example, if the loan is being used to purchase real estate, the agreement must be notarized in order to be considered legal. And if the loan is being used to start a business, the agreement must be notarized in order to be considered binding.