Legal Loan Document Template Free6 min read

A legal loan document template is a document that is used to outline the terms and conditions of a loan between two or more individuals or entities. This document typically includes information on the interest rate, the repayment schedule, and any other pertinent details related to the loan.

There are many different types of legal loan document templates, and it is important to choose one that is appropriate for your specific situation. It is also important to make sure that the terms of the loan are fair and equitable for all parties involved.

If you are considering taking out a loan, it is important to consult with a lawyer to make sure that you are fully aware of your rights and responsibilities. It is also a good idea to have a legal loan document template in place so that there are no misunderstandings about the terms of the loan.

Table of Contents

How do I make a legal loan document?

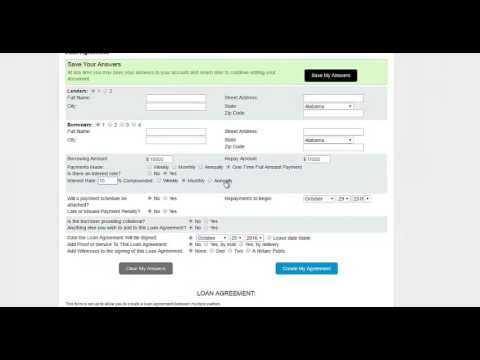

When it comes to making a loan document, there are a few key things to keep in mind. First, you’ll want to make sure that the document is legally binding, so it’s important to have a clear understanding of the laws in your state. Additionally, you’ll want to be sure to include all the necessary information in the document, including the amount of the loan, the interest rate, and the repayment schedule.

If you’re not sure where to start, there are a number of templates available online that can help you create a loan document that is legally binding in your state. Additionally, you can consult with an attorney to make sure that you’re including all the necessary information in your document.

Ultimately, the key to a successful loan document is to make sure that everything is clearly spelled out and that both parties understand the terms of the agreement.

What is a free loan agreement?

A free loan agreement is a written agreement between two parties, where one party lends money to the other party and sets out the terms and conditions of the loan. The agreement should include the amount of the loan, the interest rate, the repayment schedule, and any other terms and conditions of the loan.

When entering into a loan agreement, it is important to make sure that both parties are clear on the terms and conditions of the loan. It is also important to make sure that both parties have agreed to the same terms, as any discrepancies in the agreement could lead to disagreements down the road.

If you are thinking of taking out a loan, it is important to consult with an attorney to make sure that you are entering into a legal and binding agreement.

What is a simple loan agreement?

A loan agreement is a contract between a borrower and a lender. The borrower agrees to repay the loan in accordance with the terms of the agreement. The lender may use the loan agreement to secure a loan.

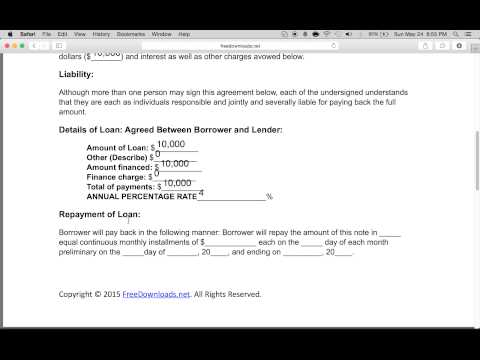

A loan agreement should include the following information:

-The name of the borrower and the lender

-The amount of the loan

-The interest rate

-The repayment schedule

-The consequences of default

-The jurisdiction governing the agreement

The loan agreement should be tailored to the specific needs of the borrower and the lender. It is important to consult an attorney to ensure that the agreement is drafted correctly.

How do I write a loan agreement letter?

A loan agreement letter is a document that outlines the terms and conditions of a loan between two parties. The letter should include the following information:

-The name and contact information of both the lender and the borrower

-The amount of the loan

-The interest rate

-The repayment schedule

-The consequences of late or missed payments

-The cancellation or default clause

The letter should be clear and concise, and both parties should sign and date it.

Can I write my own loan agreement?

Yes, you can write your own loan agreement, with a little help from a lawyer or other legal professional. The key is to make sure that the agreement covers all the important points, including the amount of the loan, the interest rate, the repayment schedule, and any penalties for late or missed payments.

You’ll also need to make sure that the agreement is in compliance with your state’s laws. For example, some states require that loan agreements be in writing and be signed by both parties. Others may require that the interest rate be specified in the agreement, or that the lender provide the borrower with a written disclosure statement.

If you’re not sure about the laws in your state, it’s always best to consult with a lawyer to make sure that your agreement is legal and enforceable.

How do I write a private loan agreement for a friend?

When lending money to a friend, it’s important to have a written agreement in place to protect both parties. This article will show you how to write a private loan agreement for a friend.

The first step is to come up with a repayment plan. Decide how much money is being loaned, when the repayment will begin, and how often payments will be made. Be sure to include a grace period, in case the borrower needs a little extra time to get back on their feet.

Next, list the terms and conditions of the loan. This includes the interest rate, late payment fees, and any other penalties that may apply.

Finally, both parties should sign and date the agreement. This will help to ensure that both parties are held accountable to the terms of the loan.

Is a personal loan agreement legally binding?

A personal loan agreement is a legally binding contract between two or more individuals. The agreement outlines the terms and conditions of the loan, including the repayment schedule and interest rate.

If either party breaches the agreement, they may be held liable in a court of law. A personal loan agreement can be useful in protecting both the lender and the borrower in the event of a dispute.

It is important to note that a personal loan agreement is not the same as a promissory note. A promissory note is a legally binding contract in which the borrower agrees to repay the loan plus interest and fees.

A personal loan agreement is typically less formal than a promissory note, and may be used for smaller loans between friends or family members. It is a good idea to have a personal loan agreement in place regardless of the size of the loan, as it can help to avoid misunderstandings and disagreements down the road.