Option Contract Legal Definition9 min read

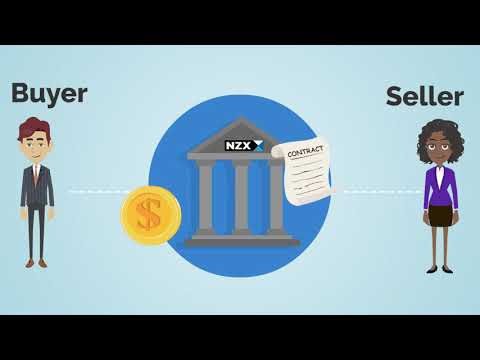

An option contract is a legal agreement between two parties in which one party, the optionor, gives the other party, the optionee, the right to buy or sell an asset at a specific price within a specific time frame. Option contracts are typically used to provide security for investments or to hedge against potential losses.

Option contracts are typically created when one party, the optionor, feels that the price of an asset is going to increase in the future, but does not want to risk losing the potential increase in value. The optionor can sell the option to the optionee, giving the optionee the right to buy the asset at the set price within a specific time frame. If the price of the asset does in fact increase, the optionee can then choose to buy the asset at the set price, locking in the increase in value. If the price of the asset decreases, the optionee can choose to not buy the asset, losing only the money paid for the option contract.

Option contracts can also be used to hedge against potential losses. For example, if a company expects that the price of a certain stock will decrease in the future, they can purchase an option contract to sell the stock at a specific price. If the stock does in fact decrease, the company will sell the stock at the set price, preventing any losses on the investment. If the stock price increases, the company can choose to not sell the stock, losing only the money paid for the option contract.

Option contracts are typically created through a written agreement between the two parties. The agreement will state the name of the optionor, the optionee, the asset being purchased or sold, the set price, and the time frame in which the option can be exercised. The optionor and optionee can also agree to specific conditions that must be met before the option can be exercised.

Option contracts are a legally binding agreement and should be created with the help of an attorney. If either party does not comply with the terms of the contract, they may be held liable in a court of law.

Table of Contents

What does option contract mean?

An option contract is a type of derivative contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (the strike price) on or before a certain date (the expiration date).

The holder of an option contract can choose to exercise the right to buy or sell the underlying asset, or they can choose to let the contract expire and forfeit the right.

Option contracts are often used to hedge against risk, for example, by an investor who is worried about a potential decline in the price of a stock they own.

What does option mean in legal terms?

What does option mean in legal terms?

Option has a few different legal meanings, but in most cases, it refers to the right to buy or sell something at a specific price within a certain time frame. For example, a company might offer its employees the option to purchase shares in the company at a discounted price. This gives employees the option to buy shares at a price that’s lower than the market price.

Another common use of the term option is in contracts. For example, a seller might give the buyer the option to purchase the property at a later date. This gives the buyer the option to buy the property, but it doesn’t obligate them to do so.

Options can be a valuable tool in business negotiations. They provide a way for both parties to gain something without having to give up anything. Options can also be used to protect against risk. For example, a company might give its employees the option to buy shares in the company at a discounted price, even if the company is doing poorly. This gives employees the option to sell their shares at a higher price if the company recovers.

Options can be a valuable tool in business negotiations. They provide a way for both parties to gain something without having to give up anything. Options can also be used to protect against risk. For example, a company might give its employees the option to buy shares in the company at a discounted price, even if the company is doing poorly. This gives employees the option to sell their shares at a higher price if the company recovers.

Options can also be used to hedge against risk. For example, a company might buy options on a stock that it thinks is going to go down. This gives the company the option to sell the stock at a higher price if the stock does go down.

What is an option contract and when is it binding?

An option contract is an agreement between two parties in which the option buyer has the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specified time frame. Option contracts are binding, meaning that both the buyer and the seller are obligated to fulfill the terms of the contract.

What is an option contract example?

An option contract is a binding agreement between two parties in which the purchaser (option holder) has the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a predetermined date (expiration date).

An option contract can be either a call option or a put option, depending on whether the purchaser has the right to buy (call) or sell (put) the underlying asset.

The most common underlying assets are stocks, but options can be based on a wide range of assets, including bonds, commodities, and currencies.

The purchaser of an option contract pays a premium to the seller. This premium is the price of the option and is nonrefundable, even if the option is never exercised.

The strike price is the price at which the underlying asset can be purchased (in the case of a call option) or sold (in the case of a put option).

The expiration date is the date on or before which the option must be exercised or it will expire worthless.

The most important thing to remember about options is that they are a wasting asset. This means that the option’s value decreases as it gets closer to expiration.

An option contract is a legal and binding agreement between two parties. The purchaser of an option contract has the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price (strike price) on or before a predetermined date (expiration date).

The most common underlying assets are stocks, but options can be based on a wide range of assets, including bonds, commodities, and currencies.

The purchaser of an option contract pays a premium to the seller. This premium is the price of the option and is nonrefundable, even if the option is never exercised.

The strike price is the price at which the underlying asset can be purchased (in the case of a call option) or sold (in the case of a put option).

The expiration date is the date on or before which the option must be exercised or it will expire worthless.

The most important thing to remember about options is that they are a wasting asset. This means that the option’s value decreases as it gets closer to expiration.

What makes an option contract legally enforceable?

When two parties agree to enter into an option contract, they are essentially agreeing to a set of terms and conditions that will govern their interaction. This contract is legally enforceable, meaning that both parties are obligated to abide by its terms.

There are a few key factors that make an option contract legally enforceable. First, both parties must have agreed to the contract willingly and knowingly. They must also have the legal capacity to enter into a contract, meaning they are of sound mind and are not under any duress or undue influence.

The contract must also be valid, meaning it has been entered into for a legal purpose and does not violate any laws. Finally, it must be capable of being performed, meaning that both parties have the ability to carry out their obligations under the contract.

If any of these factors are not met, the option contract may not be legally enforceable. This can lead to disputes between the parties, which may need to be resolved in court.

What are the characteristics of an option contract?

An option contract is a financial contract that gives the holder the right, but not the obligation, to buy or sell an underlying security or commodity at a specified price (the strike price) on or before a certain date (the expiration date).

Option contracts can be classified as either puts or calls. A put gives the holder the right to sell the underlying security or commodity at the strike price, while a call gives the holder the right to buy the underlying security or commodity at the strike price.

The most important characteristic of an option contract is its strike price. The strike price is the price at which the holder of the option can buy (in the case of a call) or sell (in the case of a put) the underlying security or commodity.

Another important characteristic of an option contract is its expiration date. The expiration date is the date on or before which the holder of the option must exercise their right to buy or sell the underlying security or commodity.

Option contracts can be traded on exchanges just like other securities. They can also be bought and sold over the counter.

What are the elements of an option contract?

An option contract is a type of security that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. Options contracts are standardized agreements that are traded on exchanges.

There are four key elements to an option contract: the underlying asset, the strike price, the expiration date, and the premium. The underlying asset is the asset that the option contract gives the holder the right to buy or sell. The strike price is the price at which the holder can buy or sell the underlying asset. The expiration date is the date on which the option contract expires and can no longer be exercised. The premium is the price that the holder pays for the option contract.