Sample Legal Billing Entries8 min read

Legal billing can be a complex and time-consuming process. However, it is important to keep accurate and detailed records of all the work that has been done in order to generate an accurate bill.

Below is an example of some of the entries that might be found in a legal billing invoice:

1. Date of service

2. Description of service

3. Time spent on service

4. Fee for service

5. Total amount due

Date of service: This entry would list the date on which the particular service was provided.

Description of service: This entry would list a brief description of the service that was provided.

Time spent on service: This entry would list the amount of time that was spent on the particular service.

Fee for service: This entry would list the fee that was charged for the particular service.

Total amount due: This entry would list the total amount that is due for the services that were provided.

Table of Contents

Why do lawyers bill in 6 minute increments?

Lawyers bill in six minute increments for a few reasons. First, it is more efficient for them to bill this way. Lawyers can generally work six minutes without taking a break, and this way they can track their time more easily. It is also easier for clients to understand how much a lawyer’s services will cost.

Some people believe that lawyers bill in six minute increments in order to make more money. However, this is not generally the case. Lawyers generally do not make much more money by billing in six minute increments instead of by the hour.

Overall, there are a few reasons why lawyers bill in six minute increments. It is more efficient for lawyers, it is easier for clients to understand, and it is not generally more expensive for clients.

How do you bill time in a law firm?

In order to bill time in a law firm, you need to first understand the different types of billing that are available. There are three types of billing – time and materials, flat fee, and contingency.

Time and materials billing is when the client is charged for the time spent on the project, as well as the materials used. This type of billing is common for projects that are not time-sensitive, such as research or document review.

Flat fee billing is when the client is charged a fixed price for the project, regardless of how long it takes to complete. This type of billing is common for routine legal tasks, such as preparing a contract or wills.

Contingency billing is when the lawyer charges a percentage of the amount recovered in the case. This type of billing is common for personal injury or other types of litigation.

Once you have determined the type of billing to use, you need to bill the time. Billing time is done in increments of six minutes. Lawyers will often use a time sheet to track the time spent on each task. The time sheet is then submitted to the accounting department, who will create an invoice for the client.

There are a few things to keep in mind when billing time. First, make sure to track all the time spent on the project, including phone calls, emails, and travel time. Second, make sure to bill the time accurately. This means billing for the time spent on the task, not the time spent in the office. Finally, be sure to keep track of any expenses incurred on the project, such as photocopies, postage, or travel expenses.

What tasks can be billed to the client?

As a freelancer, you may be wondering what tasks you can bill to your clients. In general, you can bill for any task that you perform as part of your work for the client. This may include tasks such as writing, designing, or editing.

It’s important to note that you should always bill for the time you spend on a task, rather than the results of that task. For example, if you spend two hours editing a document, you should bill for two hours, even if the document is only edited for one hour. This ensures that you are fairly compensated for your work.

If you are not sure whether a task can be billed to a client, it’s best to ask your client first. This will help to ensure that there are no surprises when it comes time to bill.

What are the most common types of billing methods?

There are a variety of different billing methods that businesses can use. The most common types of billing methods are explained below.

The most common type of billing method is the time and material billing method. Under this method, businesses are charged for the time that their employees spend on a project, as well as the materials that are used. This is the most common billing method for service businesses.

Another common billing method is the flat rate billing method. Under this method, businesses are charged a set fee for a particular project, regardless of how long it takes to complete. This is the most common billing method for construction projects.

Another common billing method is the cost plus billing method. Under this method, businesses are charged for the cost of the materials and the labor that is used to complete a project. This is the most common billing method for manufacturing businesses.

The last common billing method is the per unit billing method. Under this method, businesses are charged a set price for every unit that is produced. This is the most common billing method for production businesses.

How do you record billable hours?

In order to accurately bill clients for the time they’ve spent working on a project, it’s important to keep track of how many hours you’ve spent on the project. This can be done in a number of ways, but there are a few methods that are more common than others.

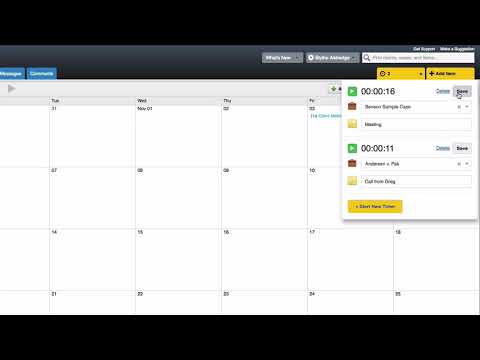

One way to track billable hours is to use a timer. This can be an app on your phone or a physical timer that you set for each task you work on. This is a good way to track time for short tasks, but it can be difficult to use for tasks that take longer than an hour.

Another way to track billable hours is to keep a log of the time you’ve worked each day. This can be done in a notebook or in a spreadsheet. This is a good way to track time for long tasks, but it can be difficult to remember what you worked on each day.

A third way to track billable hours is to use a time tracking software. This is a good way to track time for both short and long tasks, and the software can often generate reports that show how much time was spent on each task.

No matter how you choose to track your billable hours, it’s important to be consistent. This will help ensure that you’re accurately billing your clients for the time they’ve spent working on their project.

How do you calculate billable rate?

How do you calculate billable rate?

This is a question that many people in the legal industry struggle with. There is no one right answer, but there are some basic steps that you can follow to come up with a reasonable estimate.

First, you need to calculate your overhead costs. This includes items like rent, office supplies, and salaries for support staff. Once you have that number, you need to divide it by the number of billable hours you expect to work each year. This will give you your overhead rate.

Next, you need to calculate your revenue goal. This is the amount of money you want to bring in each year. To determine this number, you need to consider your personal expenses and the amount of money you need to cover your overhead costs.

Finally, you need to divide your revenue goal by your overhead rate. This will give you your billable rate.

Keep in mind that this is just a rough estimate. Your actual billable rate may be higher or lower depending on a variety of factors.

How do you bill a client for the first time?

When you start working with a new client, one of the first things you need to do is bill them for your services. This can seem daunting, but it’s actually pretty simple. Here’s a guide on how to bill a client for the first time.

The first thing you need to do is figure out how much you’re going to charge for your services. This can be tricky, but it’s important to be fair and reasonable. Once you’ve settled on a price, you need to create an invoice for your client.

Your invoice should include all the relevant information, such as the amount you’re charging, the date, and any applicable taxes. You should also include your contact information, as well as the contact information for your client.

Once you’ve created your invoice, you can send it to your client. They may need to approve it before you can start working, so be sure to check with them first.

Once your invoice is approved, you can start working on the project. Be sure to keep track of your hours and expenses, so you can bill your client for those as well.

It’s important to stay organized and keep track of your finances when billing a client for the first time. By following these steps, you can make the process as smooth and stress-free as possible.