Treasury Nominee Wants Cryptocurrencies Legitimate9 min read

Steven Mnuchin, President-elect Donald Trump’s nominee for Treasury secretary, wants to legitimize cryptocurrencies in order to prevent them from being used for illegal activities.

In a recent interview with CNBC, Mnuchin said that he wants to “make sure that bad people can’t use these currencies to do bad things.” He also emphasized the importance of regulating cryptocurrencies in order to prevent money laundering and terrorist financing.

Mnuchin’s comments come at a time when the legitimacy of cryptocurrencies is increasingly being called into question. In recent months, a number of countries, including China and South Korea, have taken steps to regulate or even ban cryptocurrencies.

While Mnuchin’s comments may be seen as a positive development by the cryptocurrency community, it’s important to note that he has not yet taken a position on specific policies. It remains to be seen whether he will support measures that legitimize cryptocurrencies or simply try to regulate them more tightly.

Table of Contents

Can the government seize my crypto?

The short answer to this question is yes, the government can seize your crypto if it suspects that you are engaged in illegal activity. However, the process for doing so can be quite complicated, and the government may not be able to seize all of your cryptoassets.

The first step in seizing crypto is determining the identity of the person holding the assets. This can be difficult, as many cryptoassets are held anonymously. The government may be able to obtain this information through a subpoena or other legal process.

Once the government has identified the owner of the cryptoassets, it must prove that the assets are linked to illegal activity. This can be difficult, as the government may not be able to track the movement of the cryptoassets between wallets. In some cases, the government may be able to obtain a warrant to search the owner’s computer or other electronic devices for evidence of illegal activity.

If the government is able to prove that the cryptoassets are linked to illegal activity, it may be able to seize them. However, the government may only be able to seize the assets that are held in the United States. Cryptoassets that are held in other countries may be beyond the reach of the United States government.

It is important to note that the government can only seize assets that it suspects are linked to illegal activity. If you are not engaged in illegal activity, the government cannot seize your cryptoassets.

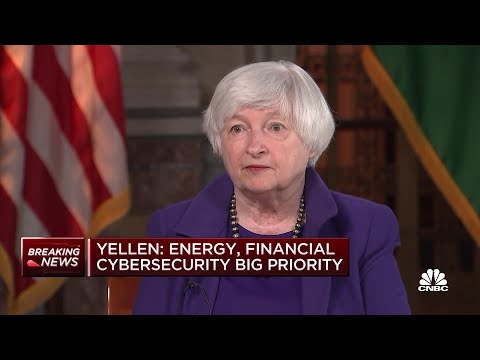

What did janet Yellen say about cryptocurrency?

On Thursday, U.S. Federal Reserve Chair Janet Yellen testified before the U.S. Senate Banking Committee, and among the topics of conversation was cryptocurrency.

In her testimony, Yellen said that the Fed does not have authority to regulate cryptocurrency, but that it is watching the growth of the market and could take action if it feels that cryptocurrencies are being used to facilitate fraudulent activities or pose a risk to the financial system.

Yellen also said that the Fed does not regard cryptocurrency as a real currency, but rather as a “speculative asset.”

This statement from Yellen is in line with the Fed’s previous statements on cryptocurrency. In December, Fed Governor Jerome Powell said that the Fed is “monitoring” cryptocurrency, and that it does not believe that Bitcoin and other digital currencies currently meet the definition of currency.

The Fed’s position on cryptocurrency is in contrast to that of other countries, such as Japan, which has recognized Bitcoin as a legal currency.

Overall, Yellen’s testimony was relatively neutral on cryptocurrency. The Fed is not ready to take any action yet, but it is keeping an eye on the market and could take action if it feels that it is necessary.

Does cryptocurrency go through probate?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin and other cryptocurrencies are also accepted as payment by some merchants.

Cryptocurrencies are often stored in digital wallets. These wallets contain a public key and a private key. The public key is used to receive cryptocurrency and the private key is used to send cryptocurrency.

Cryptocurrencies are not regulated by any government agency and are therefore subject to a high degree of risk. Cryptocurrencies are also subject to price volatility and can lose value quickly.

Does the IRS know if you buy crypto?

The Internal Revenue Service (IRS) is the United States government agency responsible for the collection of federal income taxes. In April of 2014, the IRS issued guidance regarding the taxation of virtual currencies, such as Bitcoin.

The guidance stated that virtual currencies are to be treated as property for tax purposes, and that gains or losses from the sale or exchange of virtual currency must be reported on your federal income tax return. The guidance also stated that, in some cases, wages paid in virtual currency must be reported to the IRS.

So, does the IRS know if you buy crypto? Yes, the IRS is aware of the existence of virtual currencies, and they expect taxpayers to report any gains or losses on their federal income tax returns.

How does the government track crypto?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them an appealing option for those looking to circumvent traditional financial systems.

The popularity of cryptocurrencies has led to concerns about their use for illegal activities, such as money laundering and tax evasion. Governments around the world are looking for ways to track and regulate cryptocurrencies. This has led to a variety of approaches, from outright bans to regulating exchanges and requiring identification for cryptocurrency transactions.

How does the government track cryptocurrency?

There are a number of ways governments track cryptocurrencies. One is to require cryptocurrency exchanges to identify their users. In the United States, for example, the Financial Crimes Enforcement Network (FinCEN) requires exchanges to register with them and to identify their users. This allows the government to track the movement of cryptocurrencies and to identify those involved in illegal activities.

Another way the government tracks cryptocurrencies is through blockchain analysis. Blockchain is the technology that underlies cryptocurrencies. It is a distributed database that records every cryptocurrency transaction. This allows the government to track the movement of cryptocurrencies and to identify those involved in illegal activities.

Governments are also looking at ways to track cryptocurrencies through their users’ devices. In China, for example, the government requires users to register their identities and track their transactions through their mobile devices. This allows the government to track the movement of cryptocurrencies and to identify those involved in illegal activities.

Cryptocurrencies are a new technology and the approach governments take to tracking them is constantly evolving. As more and more people use cryptocurrencies for illegal activities, the government will likely continue to find new ways to track them.

Which government owns the most bitcoin?

Bitcoin is a digital asset and a payment system invented by Satoshi Nakamoto. Transactions are verified by network nodes through cryptography and recorded in a public dispersed ledger called a blockchain. Bitcoin is unique in that there are a finite number of them: 21 million.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.

Bitcoins are digital and intangible. They exist as entries in a digital ledger, nothing more. So who owns them?

The answer to that question is a little complicated.

When you own bitcoin, you don’t actually own a physical coin or bill. You own a digital key that gives you access to a bitcoin address. The key allows you to send and receive bitcoins.

The bitcoin address is unique, and is generated when you create a new bitcoin wallet. The address is a random sequence of letters and numbers.

You can give your bitcoin address to anyone you want. They can then use it to send you bitcoins.

When you create a new bitcoin wallet, you also create a new bitcoin address. You can have as many addresses as you want.

Bitcoin is decentralized, which means it is not controlled by any government or financial institution.

This also means that it is not backed by any government or financial institution.

So who owns all the bitcoins?

Nobody really knows.

Bitcoins are created as a reward for mining, and the number of bitcoins that can be created is limited. As of June 2017, about 16.7 million bitcoins had been mined.

Bitcoins are also traded on a number of exchanges, and can be bought and sold for other currencies.

As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.

Bitcoin is still a relatively new currency, and its popularity is growing. Its value is also highly volatile.

Who knows where the value of bitcoin will be in the future?

Only time will tell.

What caused the crypto crash?

In January 2018, the crypto market experienced a massive crash, with the value of major cryptocurrencies such as Bitcoin and Ethereum falling by more than 50%.

So, what caused the crypto crash?

There are many theories, but the two most popular explanations are:

1) The crash was caused by regulatory uncertainty.

2) The crash was caused by a sell-off by speculators.

Let’s take a closer look at each of these explanations.

1) The crash was caused by regulatory uncertainty.

Many experts believe that the crypto crash was caused by regulatory uncertainty. In particular, they point to the news that South Korea was planning to ban crypto trading. This news caused a lot of panic among investors, who started to sell their cryptocurrencies.

2) The crash was caused by a sell-off by speculators.

Others believe that the crash was caused by a sell-off by speculators. They argue that the rise in prices over the past year was driven by speculation, and that when the speculators started to sell, the prices crashed.