Treasury Yellen Cryptocurrencies Legitimate Activities9 min read

Cryptocurrencies are increasingly becoming more popular, with more people investing in them as the market value of these digital assets rises. Despite this, there are still many people who are skeptical about their legitimacy, with some believing that they are nothing more than a bubble that is doomed to burst.

Recently, Treasury Secretary Steven Mnuchin addressed cryptocurrencies in a press conference, stating that he believes that they are legitimate activities, but that he is also concerned about their potential use in illicit activities. He noted that the Treasury Department is working with other government agencies to ensure that cryptocurrencies are not used for illegal activities such as money laundering and terrorist financing.

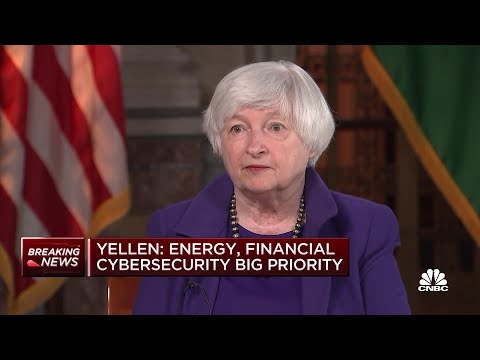

In addition, Federal Reserve Chairwoman Janet Yellen also recently spoke about cryptocurrencies, stating that she believes that they are not a threat to the financial stability of the United States. She cautioned, however, that investors should be aware of the risks associated with cryptocurrencies, as they are not backed by any government or central bank.

Despite the concerns of some, it appears that the US government is not planning to crack down on cryptocurrencies. Instead, it seems that they are looking to work with the industry to ensure that they are not used for illegal activities. This is a positive development for the cryptocurrency industry, and should help to increase confidence in these digital assets.

Table of Contents

What did Yellen say about Bitcoin?

On Thursday, Federal Reserve Chair Janet Yellen testified before the Senate Banking Committee, and she was asked about Bitcoin.

In her testimony, Yellen said that the Fed does not have the authority to regulate Bitcoin, but she added that the Fed is “monitoring the development of Bitcoin and other virtual currencies.”

Yellen also said that the Fed does not believe that Bitcoin is currently a significant threat to the US economy, but she added that the Fed is “monitoring the development of Bitcoin and other virtual currencies.”

Yellen’s comments about Bitcoin were largely positive, and her remarks suggest that the Fed is not overly concerned about Bitcoin at this point.

Which Cryptocurrency is backed by government?

There are many different types of cryptocurrency in the world today. While some are backed by private companies or organizations, others are backed by governments. In this article, we will take a look at which cryptocurrencies are backed by governments and what that means for investors.

The most well-known government-backed cryptocurrency is Bitcoin. Bitcoin is backed by the government of Japan, which means that it is considered a legal currency in that country. Other government-backed cryptocurrencies include Ethereum and Litecoin, both of which are backed by the government of China.

What does it mean for a cryptocurrency to be backed by a government? In most cases, it means that the government has officially recognized the cryptocurrency as a legal form of payment. In some cases, it also means that the government has invested in the cryptocurrency or is otherwise supporting it.

Why would a government want to back a cryptocurrency? There are a few different reasons. In some cases, the government may see the cryptocurrency as a way to promote economic growth. In other cases, the government may see the cryptocurrency as a way to combat money laundering or other financial crimes.

What are the benefits of investing in a government-backed cryptocurrency? There are a few key benefits. First, government-backed cryptocurrencies are often considered to be more stable and reliable than other cryptocurrencies. Second, they are often more accepted by merchants and other businesses. Finally, they may be more likely to be regulated and therefore more secure for investors.

What are the risks of investing in a government-backed cryptocurrency? One key risk is that the government may not be able to support the cryptocurrency in the long run. In addition, government-backed cryptocurrencies may be more likely to be regulated, which could limit your ability to trade or use them. Finally, the value of government-backed cryptocurrencies may be more sensitive to political and economic factors than other cryptocurrencies.

Is Cryptocurrency monitored by the government?

Cryptocurrency is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of new units, and verify the transfer of assets. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

The question of whether or not cryptocurrency is monitored by the government is a complex one with no definitive answer. Cryptocurrencies are not regulated by the government in most cases, which means that there is little to no oversight of this asset class. However, some governments are starting to take an interest in cryptocurrencies and are exploring ways to regulate them.

For example, the Chinese government announced in September 2017 that it would begin to regulate cryptocurrency trading in an effort to curb capital outflow and volatility in the Chinese yuan. And in February 2018, the Indian government announced that it would be banning the use of cryptocurrencies in India.

So, while the government largely doesn’t monitor cryptocurrency activity, there is a growing trend of governments taking an interest in this asset class and exploring ways to regulate it.

Does the US government recognize Cryptocurrency?

Cryptocurrency has been around for a while now, and many people are still unsure of what it is and how it works. Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrency is not regulated by any government, which has led to some concerns about its legality. However, the United States government has not taken a clear stance on cryptocurrency. Some officials have spoken out against it, while others have said that it should be regulated.

In 2013, the Internal Revenue Service issued a guidance stating that Bitcoin and other virtual currencies are to be treated as property for tax purposes. This means that cryptocurrency is subject to capital gains taxes when it is sold. The guidance also states that payments made in cryptocurrency are subject to income tax.

In 2015, the Commodity Futures Trading Commission ruled that Bitcoin and other virtual currencies are commodities, which means they can be traded on commodity exchanges.

So far, the United States government has not taken any definitive action on cryptocurrency. It is still unclear what the government’s stance on cryptocurrency is, and how it will be regulated in the future.

Is Janet Yellen against Cryptocurrency?

Janet Yellen, the Chair of the Board of Governors of the Federal Reserve System, has not made any public statements that could be construed as indicating that she is against cryptocurrency. However, some people in the cryptocurrency community have interpreted her statements as being negative about the technology.

For example, in a speech to the Commonwealth Club of California in San Francisco in September 2017, Yellen said that “cryptocurrencies are intriguing, but I am not sure they are a stable source of value, and they are not currently used in transactions.”

This statement was interpreted by some as a sign that Yellen is not convinced that cryptocurrencies are a stable and viable form of currency. However, it is important to note that she did not say that she is against them, and she did not say that they will never become a mainstream form of payment.

In fact, in the same speech, Yellen said that “the underlying technology of bitcoin is interesting and could be useful in the future.” She also said that the Federal Reserve is “very interested in the technology” and is “monitoring developments in this area.”

So, it seems that Yellen is not against cryptocurrency per se, but she is unsure about its long-term viability. She is hopeful that the technology can be used in the future to improve the payment system, but she is not convinced that it is ready to be used as a mainstream form of payment yet.

Is crypto a systemic risk?

Since the birth of Bitcoin in 2009, cryptocurrencies have been a hot topic of debate. While some people see them as a revolutionary new way to conduct transactions, others are worried about the potential for them to cause a systemic risk.

What is Systemic Risk?

Systemic risk refers to the risk that an event or series of events will cause a domino effect that will damage the entire financial system. This could include a bank failure, a stock market crash, or a natural disaster.

Is Crypto a Systemic Risk?

There is no definitive answer to this question, as opinions vary greatly on the topic. However, there are a few factors that could make cryptocurrencies a potential systemic risk:

1. Cryptocurrencies are decentralized, meaning they are not regulated by any government or financial institution. This makes them vulnerable to fraud and manipulation.

2. The value of cryptocurrencies is highly volatile, and they are not backed by any physical assets. This makes them susceptible to price crashes.

3. Cryptocurrencies are still in its infancy, and many people are not familiar with them. This could lead to a market crash if investors decide to pull their money out of cryptocurrencies.

4. Cryptocurrencies are often used for illicit activities, such as money laundering and drug trafficking. This could lead to increased regulation from governments, which could damage the market.

While there are certainly some risks associated with cryptocurrencies, it is too early to say whether or not they pose a systemic risk to the financial system.

Will US Ban cryptocurrency?

The US government is considering a potential ban on cryptocurrency. This decision could have a significant impact on the industry as a whole.

Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin, the most well-known cryptocurrency, was created in 2009.

Cryptocurrency has become increasingly popular in recent years. This is in part due to its volatility; the value of Bitcoin, for example, has been known to fluctuate significantly. This volatility has made some investors wary of investing in cryptocurrency, while others see it as an opportunity to make a quick profit.

The US government is now considering a potential ban on cryptocurrency. This decision could have a significant impact on the industry as a whole. If the US government does decide to ban cryptocurrency, it could become much more difficult for investors to buy and sell it. This could lead to a decrease in the value of cryptocurrency, and could also discourage people from investing in it.

However, it is important to note that a ban on cryptocurrency is not a certainty. The US government has not made a final decision on this matter, and it is still possible that it will decide not to ban cryptocurrency.

If the US government does decide to ban cryptocurrency, it will not be the first country to do so. China, for example, banned cryptocurrency in September of 2017. This ban caused the value of Bitcoin to drop significantly, and it has yet to recover.

It is still too early to say what the impact of a potential ban on cryptocurrency would be. However, it is clear that such a ban would have a significant impact on the industry as a whole.