Company Is A Legal Entity8 min read

A company is a legal entity, meaning it has a separate legal identity from its owners. This means that the company can enter into contracts, own property and sue or be sued in its own name.

A company is formed by registering its articles of incorporation with the appropriate government agency. The articles of incorporation set out the company’s name, purpose, incorporators and shareholders.

The company’s shareholders are responsible for electing the company’s directors, who are responsible for managing the company’s affairs. The directors must act in the best interests of the company and its shareholders and must disclose any potential conflicts of interest.

The shareholders and directors are not personally liable for the company’s debts or obligations, except in limited circumstances. This means that the company’s assets are used to pay off its debts, not the personal assets of the shareholders or directors.

A company can be a member of a trade association and can enter into contracts with other companies. It can also own property, including land and buildings.

A company is a separate legal entity and is not affected by the death, incapacity or bankruptcy of its shareholders or directors.

Table of Contents

What makes a company a legal entity?

A company is a legal entity when it is registered with the relevant authorities. This registration confers a number of legal rights and protections on the company, including the ability to enter into contracts and to sue and be sued.

A company is formed by registering a company name and company type with the Companies Registration Office (CRO). The company type will determine the legal structure of the company. The most common company types are private companies limited by shares and public companies limited by shares.

A company must have at least one director and one shareholder. The shareholders must own at least one share in the company. The directors of the company are responsible for running the company and must act in the best interests of the company.

The company must also have a registered office. The registered office is the official address of the company and must be located in the Republic of Ireland.

A company must file annual returns with the CRO. The annual returns must include details of the company’s directors, shareholders and registered office.

A company is a separate legal entity from its shareholders and directors. The company can enter into contracts and sue and be sued in its own name. This separation of liability protects the shareholders and directors from being held liable for the company’s debts and liabilities.

A company is a valuable asset for a business. It provides a number of legal rights and protections which can help to protect the business and its shareholders. It is important to ensure that a company is registered with the CRO and to comply with the annual return requirements.

Is company a legal entity type?

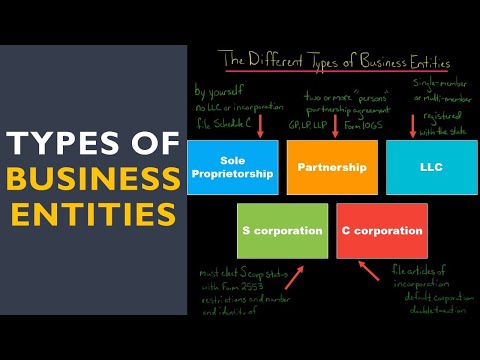

When starting a business, one of the first decisions you’ll need to make is what type of legal entity to register your company as. This decision can have a major impact on your business, so it’s important to understand the different types of legal entities and what each one offers.

A company is a legal entity type, which means it is a separate legal entity from its owners. This offers certain benefits, such as limited liability for the company’s owners. This means that the company’s owners are not personally responsible for the company’s debts or liabilities.

There are several different types of companies, including limited companies, unlimited companies, and public companies. Each type offers different benefits and restrictions. For example, a limited company is more expensive and complicated to set up than an unlimited company, but it offers greater protection for the company’s owners. A public company is more heavily regulated and has higher filing fees, but also offers greater visibility and potential for growth.

It’s important to consult with an attorney when deciding what type of company to register your business as. An attorney can help you understand the different types of companies and which one is best for your business.

Is a company considered an entity?

Is a company considered an entity?

A company is considered an entity for tax purposes. This means that a company is a separate legal entity from its owners and is taxed as a separate entity. The company’s income and expenses are reported on its own tax return, and the company is responsible for paying its own taxes.

There are a few exceptions to this rule. For example, if a company is owned by a single individual, the company and the individual are considered one entity for tax purposes. Similarly, if a company is owned by a husband and wife, the company and the spouses are considered one entity for tax purposes.

What is type of legal entity?

What is a type of legal entity?

A type of legal entity is a specific kind of organization that has been recognized by law as having a particular set of rights and responsibilities. There are many different types of legal entities, each of which has its own set of rules and regulations. Some of the most common types of legal entities include corporations, limited liability companies, and partnerships.

What are the benefits of forming a legal entity?

There are a number of benefits to forming a legal entity. Some of the most common benefits include limited liability protection, tax advantages, and the ability to raise capital. By forming a legal entity, business owners can protect their personal assets from being seized in the event of a lawsuit. Additionally, legal entities may be able to take advantage of certain tax benefits, and they can often raise capital more easily than individuals.

What are the most common types of legal entities?

The most common types of legal entities include corporations, limited liability companies, and partnerships. Each of these entities has its own set of rules and regulations, and business owners should consult with an attorney to determine which type of legal entity is best suited for their business.

What is a legal entity example?

A legal entity is a company, partnership, or other organization that has a separate legal identity from its owners. This means that the company can own property, enter into contracts, and sue or be sued in its own name. A legal entity is created when its owners file articles of incorporation or create a partnership agreement.

There are a number of different types of legal entities, each with its own advantages and disadvantages. The most common types are corporations, limited liability companies (LLCs), and partnerships.

A corporation is a legal entity that is owned by shareholders. The shareholders own the company’s assets and are responsible for the company’s debts. A corporation can have an unlimited number of shareholders and is subject to a variety of laws and regulations.

A limited liability company is a legal entity that is owned by members. The members are not liable for the company’s debts beyond the amount of money they have invested in the company. LLCs are subject to fewer laws and regulations than corporations, and are often preferred by small business owners.

A partnership is a legal entity that is owned by partners. The partners are responsible for the company’s debts and are liable for any injuries that occur as a result of the company’s operations. Partnerships are often used by small business owners who want to limit their liability.

What is not a legal entity?

There are many things in the world that are not legal entities. While it is not an exhaustive list, some things that are not legal entities include:

1. Natural Persons – Individuals are not legal entities. For example, a person cannot file a lawsuit in their own name.

2. Businesses – Corporations, LLCs, and partnerships are not legal entities. They are created by statute, and are separate and distinct from their owners.

3. Government Agencies – Agencies of the government are not legal entities. For example, the Department of Motor Vehicles is not a separate legal entity from the state of California.

4. Foreign Countries – Foreign countries are not legal entities. For example, the United Kingdom is not a separate legal entity from the United States.

5. Domains – Domains are not legal entities. For example, example.com is not a separate legal entity from its owner, John Doe.

What type of entity is a company?

When it comes to business, there are a variety of different types of entities you can choose from. The most common are sole proprietorships, partnerships, and corporations. But what about companies? What is the difference between a company and a corporation?

The key difference between a company and a corporation is that a company is a type of business entity that is not registered with the state. This means that a company is not required to follow the same regulations as a corporation. A company can be owned by one person or a group of people, and it can be a for-profit or non-profit business.

A corporation, on the other hand, is a type of business entity that is registered with the state. This means that a corporation is required to follow certain regulations, such as issuing stock and holding annual meetings. A corporation can be owned by one person or a group of people, and it can be a for-profit or non-profit business.

So, which type of entity is right for your business? That depends on your specific business needs and goals. If you want to be able to raise money from investors, then you will need to form a corporation. If you don’t need to raise money from investors, then a company may be a better option for you.