Company Ownership Legal Entity11 min read

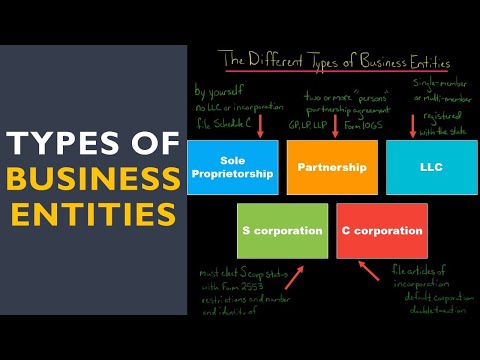

There are a few different types of company ownership legal entities, but the most common are sole proprietorship, partnership, and corporation. Each type of company has its own unique set of benefits and drawbacks, and it’s important to choose the one that is best suited for your specific business needs.

Sole Proprietorship

A sole proprietorship is the simplest type of company ownership, and it is owned and operated by a single individual. This is the most common type of company in the United States, and it is a good choice for businesses that are just starting out.

Benefits of a Sole Proprietorship

There are a few key benefits of a sole proprietorship:

1. Easy to set up – A sole proprietorship is the simplest type of company to set up, and there are no special paperwork or filings required.

2. Low startup costs – A sole proprietorship has very low startup costs, and there is no need to create a separate entity or to hire legal and accounting professionals.

3. Tax advantages – A sole proprietorship is taxed as a single entity, which can be advantageous for small businesses.

Drawbacks of a Sole Proprietorship

There are a few drawbacks to consider before setting up a sole proprietorship:

1. Limited liability – A sole proprietor is personally liable for all debts and liabilities of the business.

2. Limited resources – A sole proprietor has limited resources and can only grow the business as fast as he or she can personally manage it.

3. Limited growth potential – A sole proprietorship has limited growth potential, and it can only expand as far as the owner is willing and able to take it.

Partnership

A partnership is a business that is owned and operated by two or more individuals. Partnerships can be structured in a number of different ways, but the most common type is a general partnership.

Benefits of a Partnership

There are a few key benefits of a partnership:

1. Easy to set up – Partnerships are easy to set up, and there is no special paperwork or filings required.

2. Low startup costs – Partnerships have very low startup costs, and there is no need to create a separate entity or to hire legal and accounting professionals.

3. Tax advantages – Partnerships are taxed as a single entity, which can be advantageous for small businesses.

Drawbacks of a Partnership

There are a few drawbacks to consider before setting up a partnership:

1. Limited liability – Partners are personally liable for all debts and liabilities of the business.

2. Limited resources – Partners have limited resources and can only grow the business as fast as they can personally manage it.

3. Limited growth potential – Partnerships have limited growth potential, and they can only expand as far as the partners are willing and able to take it.

Corporation

A corporation is a separate legal entity that is owned by shareholders. It is the most complex type of company ownership, and it requires a fair amount of paperwork and legal filings to set up.

Benefits of a Corporation

There are a few key benefits of a corporation:

1. Limited liability – Shareholders are personally liable only for the amount of money they have invested in the company.

2. Separate legal entity – A corporation is a separate legal entity, which offers a high level of protection from personal liability.

3. Tax advantages – A corporation is taxed as a separate entity, which can be advantageous for larger businesses.

4

Table of Contents

Is a legal entity the same as a company?

There is often confusion between the terms “legal entity” and “company”. While they are related, they are not one and the same.

A legal entity is an entity created by law, either through legislation or under common law. It can be an individual, a partnership, a company or a trust. A company is a type of legal entity, specifically a corporation.

One of the key features of a legal entity is that it has a separate legal personality from its owners. This means that the legal entity can own property, enter into contracts and be sued in its own name. The owners of the legal entity are not personally liable for the debts and obligations of the entity.

A company is a type of legal entity that is specifically recognised by law. It is a corporation, which is a type of entity that is made up of one or more shareholders. The shareholders are the owners of the company and are liable for the debts and obligations of the company.

There are a number of benefits of using a company as a legal entity. A company is a separate legal entity, which means that the owners are not personally liable for the debts and obligations of the company. This can be helpful if the company becomes insolvent as the owners are not at risk of losing their personal assets.

A company is also a tax-efficient vehicle. The profits of the company are taxed at a lower rate than the personal income of the shareholders. This can be a significant advantage for businesses that are looking to minimise their tax liability.

While a company is the most common type of legal entity, there are a number of other options available. These include:

– Individual: An individual is a natural person and the simplest form of legal entity. An individual can own property and enter into contracts in their own name. The individual is liable for the debts and obligations of the entity.

– Partnership: A partnership is a type of business entity that is made up of two or more individuals. The partners are jointly and severally liable for the debts and obligations of the partnership.

– Company: A company is a type of corporation that is made up of one or more shareholders. The shareholders are the owners of the company and are liable for the debts and obligations of the company.

– Trust: A trust is a type of legal entity that is made up of one or more trustees. The trustees are responsible for the management of the trust and are liable for the debts and obligations of the trust.

What are the 4 types of business ownership?

There are various types of business ownership, and each offers its own advantages and disadvantages. The four most common types of business ownership are:

1. Sole proprietorship

2. Partnership

3. Corporation

4. Limited liability company (LLC)

Sole proprietorship is the simplest type of business ownership. The business is owned and operated by a single individual, and there is no legal distinction between the business and the owner. This type of ownership is common among small businesses, and it offers the owner complete control over the business. However, the owner assumes all the risks and liabilities of the business.

Partnership is a type of business ownership in which two or more individuals own and operate the business. The partners share both the risks and rewards of the business, and they must agree on major decisions. This type of ownership is common among small businesses.

A corporation is a type of business ownership in which the business is legally separate from the owners. The owners (shareholders) of the corporation own stock in the company, and they are entitled to vote on major decisions. A corporation offers limited liability to its shareholders, which means that they are not personally responsible for the debts and liabilities of the company. This type of ownership is common among larger businesses.

A limited liability company (LLC) is a type of business ownership that combines the features of a corporation and a partnership. The owners of an LLC are called members, and they enjoy limited liability for the debts and liabilities of the company. An LLC is a popular choice for small businesses because it offers the limited liability of a corporation and the tax advantages of a partnership.

What is legal entity name of the owner?

When starting a business, it’s important to choose the right legal structure. This will determine how your business is taxed and regulated. One important decision you’ll have to make is what to name your business.

The legal name of a business is the name it is registered under with the government. This is typically the name of the company or the name of the owner. If you’re a sole proprietor, your legal name is your own name. If you’re a partnership, your legal name is the name of the partnership. If you’re a corporation, your legal name is the name of the company.

There are a few things to keep in mind when choosing a business name. The name can’t be the same as another business name in your state. It also can’t be obscene or contain words that are restricted by the government.

Make sure to do a trademark search to make sure the name is available and no one else is using it. You can also register your name with the government to make sure no one else can use it.

Choosing the right legal name for your business is an important decision. Make sure to do your research and choose a name that is available and compliant with government regulations.

What is type of legal entity?

A legal entity is an entity that has legal rights and responsibilities. There are many different types of legal entities, including corporations, limited liability companies, and partnerships.

A corporation is a type of legal entity that is separate and distinct from its owners. It has its own legal rights and responsibilities, and can enter into contracts and sue and be sued. Corporations are typically formed by filing articles of incorporation with the state.

A limited liability company (LLC) is a type of legal entity that provides limited liability to its owners. This means that the owners of an LLC are not personally liable for the debts of the LLC. LLCs are typically formed by filing articles of organization with the state.

A partnership is a type of legal entity that is formed by two or more people who agree to form a business together. Partnerships are typically not separate and distinct from their owners, and do not have their own legal rights and responsibilities. Partnerships are typically formed by filing a partnership agreement with the state.

What is legal entity of a company?

A company is a legal entity separate from its owners. This means that the company has its own rights and obligations, and can enter into contracts and sue or be sued in its own name. The company is also responsible for its own debts.

There are a number of different types of company, each with its own set of rules. The most common type of company is a limited company. This is a company which has been registered with the Companies House, and which has shares which can be traded on the stock market.

Other types of company include limited liability partnerships (LLPs), unlimited companies and community interest companies (CICs).

What is a legal entity example?

What is a legal entity example?

A legal entity is a term used in business law to refer to a corporation, limited liability company, or partnership. These are all separate legal entities from their owners, and they have their own rights and liabilities. For example, a corporation can enter into contracts and sue or be sued in its own name.

A limited liability company offers limited liability to its owners, meaning that they are only liable for the amount of money they have invested in the company. Partnerships offer limited liability to their partners as well, but they are also liable for any debts the partnership may incur.

It’s important to understand the differences between these types of legal entities, as they have different tax implications and governance structures. For example, a corporation is taxed at a different rate than a partnership, and a board of directors governs a corporation while a partnership is managed by its partners.

What is legal entity example?

A legal entity is a business or organization that has been granted the power to act as a single entity in the eyes of the law. This means that the legal entity can enter into contracts, own property, and sue and be sued in its own name.

There are a number of different types of legal entities, each with its own specific set of rules and regulations. The most common types of legal entities are corporations, partnerships, and limited liability companies (LLCs).

Corporations are the most common type of legal entity in the United States. A corporation is a separate legal entity from its owners, and is typically managed by a board of directors. The owners of a corporation are called shareholders, and they own shares in the company.

Partnerships are also common in the United States. A partnership is a business owned by two or more people. The partners share in the profits and losses of the business, and are jointly and severally liable for any debts the partnership may incur.

Limited liability companies are a newer type of legal entity, and are becoming increasingly popular. An LLC is a business that is owned by one or more people, and the owners are typically not liable for any debts the LLC may incur. LLCs offer the limited liability of a corporation, while still providing the tax benefits of a partnership.