Four Types Of Business Legal Entities11 min read

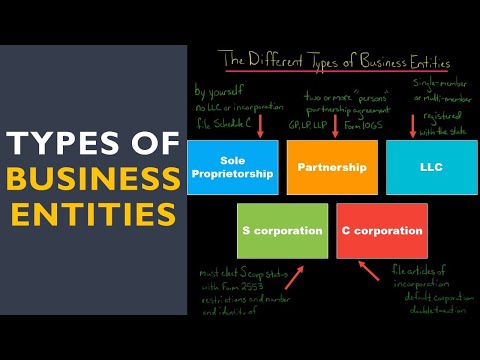

When starting a business, one of the first decisions you’ll need to make is what type of legal entity to create. There are four types of business legal entities: sole proprietorship, partnership, corporation, and limited liability company (LLC). Each type of entity has its own set of advantages and disadvantages, so it’s important to choose the right one for your business.

The most common type of business legal entity is the sole proprietorship. A sole proprietorship is a business owned by one person. There are no formal requirements to establish a sole proprietorship, and it can be started with just a few simple steps. The biggest advantage of a sole proprietorship is that it’s the simplest and most inexpensive business entity to set up. There are no registration fees, and you don’t need to hire a lawyer or accountant to establish it. Additionally, the owner of a sole proprietorship is personally liable for all the debts and liabilities of the business. This means that if the business fails, the owner will have to pay back all the debts out of their own pocket.

A partnership is a business owned by two or more people. Like a sole proprietorship, there are no formal requirements to establish a partnership. Partnerships can be formed by simply agreeing to do business together. The biggest advantage of a partnership is that it’s relatively simple and inexpensive to set up. Additionally, the owners of a partnership are personally liable for the debts and liabilities of the business. This means that if the business fails, the partners will have to pay back all the debts out of their own pockets.

A corporation is a type of business entity that is separate and distinct from its owners. To establish a corporation, you must file articles of incorporation with your state’s Secretary of State. There are a number of formal requirements that must be met in order to establish a corporation, and it can be expensive to do so. The biggest advantage of a corporation is that it offers limited liability to its owners. This means that the owners are only liable for the debts and liabilities of the corporation up to the amount of their investment in the business.

A limited liability company (LLC) is a type of business entity that combines the features of a corporation and a partnership. LLCs are relatively simple and inexpensive to set up, and they offer limited liability to their owners. The biggest disadvantage of an LLC is that its owners are not personally liable for the debts and liabilities of the business. This means that if the business fails, the owners will not have to pay back any of the debts.

Table of Contents

What are the 4 types of business legal entities?

There are four types of business legal entities: corporations, limited liability companies (LLCs), partnerships, and sole proprietorships.

A corporation is a legal entity created by the state that is separate from its owners. It has its own legal rights and liabilities, and can sue and be sued. A corporation must have a board of directors and shareholders.

An LLC is a legal entity created by the state that is separate from its owners. It has its own legal rights and liabilities, and can sue and be sued. An LLC can have one or more members.

A partnership is a legal entity created by two or more people. It has its own legal rights and liabilities, and can sue and be sued. A partnership must have a general partner and one or more limited partners.

A sole proprietorship is a business owned by one person. It has its own legal rights and liabilities, and can sue and be sued.

What is type of legal entity?

There are a few different types of legal entities a business can choose from. Determining the best type of legal entity for your small business can be tricky. It is important to research the different types of entities and their benefits and drawbacks to make the best decision for your company.

The most common type of legal entity is a corporation. A corporation is a separate legal entity from its owners and has its own rights and liabilities. The corporation is responsible for its own debts and can be sued separately from its owners. A corporation must file articles of incorporation with the state in which it is doing business and abide by state corporate laws.

A limited liability company (LLC) is another common type of legal entity. An LLC offers the liability protection of a corporation but is simpler and less expensive to set up than a corporation. An LLC can have one or more owners, called members. An LLC does not have to file articles of incorporation but must file a certificate of organization with the state in which it is doing business.

Another option for a small business is a sole proprietorship. A sole proprietorship is not a separate legal entity and is not taxed separately from its owner. The owner of a sole proprietorship is personally responsible for the business debts and can be sued for business-related claims. A sole proprietorship does not have to file any paperwork with the state.

There are also partnerships, which are a type of business where two or more people own and operate the business. Partnerships must file a partnership agreement with the state in which they are doing business. Partnership agreements should spell out the rights and responsibilities of the partners, how profits and losses will be divided, and how the partnership will be dissolved.

The final type of legal entity is a limited partnership. A limited partnership is similar to a partnership but has one or more general partners and one or more limited partners. The general partners manage the business and are personally liable for the debts of the business. The limited partners are not liable for the debts of the business and have limited rights in the business. Limited partnerships must file a certificate of limited partnership with the state in which they are doing business.

The best type of legal entity for your small business depends on the size and structure of your company, the state in which you are doing business, and your business goals. It is important to consult with an attorney to determine the best type of entity for your company.

What are the 5 legal forms of business?

There are five main legal forms of business in the United States:

1. Sole proprietorship

2. Partnership

3. Limited liability company (LLC)

4. Corporation

5. S corporation

Each form has its own unique benefits and drawbacks, so it’s important to choose the form that will work best for your business. Let’s take a closer look at each one.

1. Sole proprietorship

A sole proprietorship is the simplest form of business organization and is owned by one individual. There are no formal filings or paperwork required to set up a sole proprietorship, and it’s easy to get started.

The biggest drawback of a sole proprietorship is that the owner is personally liable for any debts or liabilities the business incurs. This means that the owner could be sued and held liable for damages, even if the business is bankrupt.

2. Partnership

A partnership is a business owned by two or more individuals. Like a sole proprietorship, there are no formal filings or paperwork required to set up a partnership.

Partnerships have two main drawbacks. First, each partner is personally liable for any debts or liabilities the business incurs. Second, disputes between partners can be contentious and difficult to resolve.

3. Limited liability company (LLC)

An LLC is a relatively new type of business organization that combines the benefits of a corporation and a partnership. An LLC is owned by one or more individuals, and like a corporation, the owners are protected from personal liability for any debts or liabilities the business incur

What are different types of business entities?

There are a variety of different types of business entities that a business can choose from in order to structure their organization. The type of entity that a business chooses will determine the specific rights and responsibilities that the owners of the business have. It is important to choose the type of entity that will best fit the business’ needs in order to protect the owners and the business itself.

There are four main types of business entities: sole proprietorships, partnerships, corporations, and limited liability companies (LLCs).

A sole proprietorship is the simplest type of business entity. It is a business that is owned by one person and is not a separate legal entity from the owner. The owner is personally liable for the debts and obligations of the business.

A partnership is a business that is owned by two or more people. Like a sole proprietorship, the business is not a separate legal entity from the owners and the owners are personally liable for the debts and obligations of the business.

A corporation is a business that is owned by shareholders. The corporation is a separate legal entity from the shareholders and the shareholders are not personally liable for the debts and obligations of the corporation.

An LLC is a business that is owned by members. The LLC is a separate legal entity from the members and the members are not personally liable for the debts and obligations of the LLC.

What are the 5 entities?

There are five entities that make up the basis of all reality: matter, energy, space, time, and consciousness. Each of these five are necessary for reality to exist.

Matter is the physical substance of the universe. Everything that exists is made up of matter, including planets, stars, galaxies, and everything else. Matter is composed of atoms, which are the smallest units of matter that have the properties of the element they are made of.

Energy is the driving force behind everything in the universe. It is what creates and maintains the laws of physics. Energy can take many forms, including light, heat, electricity, and radioactive particles.

Space is the emptiness or void in which all things exist. It is the container for everything in the universe.

Time is the measure of the duration of events. It is a dimension that flows forward in one direction only.

Consciousness is the awareness of reality. It is the ability to perceive and understand the world around you.

What is legal entity example?

A legal entity is a person or organization that has a separate legal personality from its owners. This means that the entity can own property, enter into contracts, and sue or be sued in its own name.

There are many types of legal entities, including corporations, limited liability companies, and partnerships. Each type of entity has its own set of rules and regulations, and it is important to choose the right type for your business.

A corporation is a type of legal entity that is separate and distinct from its owners. It is a legal entity that can own property, enter into contracts, and sue or be sued in its own name. Corporations are typically formed by filing articles of incorporation with the state government.

A limited liability company (LLC) is a type of legal entity that offers limited liability to its owners. This means that the owners of an LLC are not personally liable for the debts and obligations of the LLC. LLCs are typically formed by filing articles of organization with the state government.

A partnership is a type of legal entity that is created when two or more people agree to go into business together. Partnerships are typically formed by signing a partnership agreement. Unlike corporations and LLCs, partnerships are not separate and distinct from their owners and do not have their own legal personality. This means that the partners are personally liable for the debts and obligations of the partnership.

What are the 3 types of legal entities?

There are three types of legal entities:

1. Sole Proprietorship

A Sole Proprietorship is a business that is owned and operated by one person. The owner is responsible for all aspects of the business, including profits and losses. There is no legal distinction between the business and the owner.

2. Partnership

A Partnership is a business that is owned and operated by two or more people. Partners share ownership and are responsible for the profits and losses of the business. Partnerships are not subject to the same level of regulation as corporations, and are not protected from personal liability.

3. Corporation

A Corporation is a business that is owned by shareholders. The shareholders own the business, but are not responsible for its debts or liabilities. Corporations are regulated by the government and are protected from personal liability.