Legal Structures Of A Business11 min read

There are various legal structures of a business, and the most appropriate one for your business will depend on a range of factors, including the size and type of your business, the ownership and management structures, and your tax and legal obligations.

The most common legal structures for businesses in Australia are:

1. Sole trader

2. Partnership

3. Company

4. Trust

5. Cooperative

6. Not-for-profit organisation

7. Franchising

1. Sole trader

A sole trader is a business owner who operates their business as an individual, and is responsible for all debts and liabilities of the business. The main advantage of a sole trader structure is that it is simple and cheap to set up, and there is minimal paperwork and red tape. The main disadvantage is that the owner is personally liable for all debts and liabilities of the business.

2. Partnership

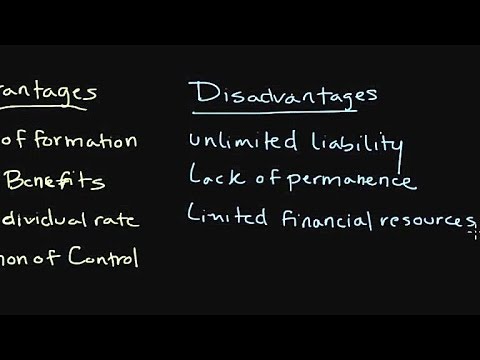

A partnership is a business owned by two or more people. Partners share the ownership, profits and losses of the business, and are jointly and severally liable for any debts and liabilities of the business. The main advantage of a partnership is that it is easy and cheap to set up, and there is minimal paperwork and red tape. The main disadvantage is that partners are jointly and severally liable for any debts and liabilities of the business.

3. Company

A company is a legal entity separate from its owners, and is the most common business structure in Australia. A company has its own legal identity, can own assets, and can enter into contracts in its own name. The main advantages of a company are that it offers limited liability protection to its owners (i.e. the owners are only liable for the amount of money they have invested in the company), and it is a more complex legal structure which offers a higher level of protection from creditors and other legal challenges. The main disadvantage of a company is that it is more expensive and complex to set up than other business structures.

4. Trust

A trust is a legal structure which is used to hold assets for the benefit of one or more beneficiaries. The main advantage of a trust is that it offers limited liability protection to the trustees (i.e. the trustees are only liable for the assets which have been entrusted to them), and it is a more complex legal structure which offers a higher level of protection from creditors and other legal challenges. The main disadvantage of a trust is that it is more expensive and complex to set up than other business structures.

5. Cooperative

A cooperative is a business owned and operated by its members for the benefit of its members. The main advantage of a cooperative is that it offers limited liability protection to its members, and it is a more complex legal structure which offers a higher level of protection from creditors and other legal challenges. The main disadvantage of a cooperative is that it is more expensive and complex to set up than other business structures.

6. Not-for-profit organisation

A not-for-profit organisation is a business which is owned and operated for the benefit of its members, but which does not make a profit. The main advantage of a not-for-profit organisation is that it offers limited liability protection to its members, and it is a more complex legal structure which offers a higher level of protection from creditors and other legal challenges. The main disadvantage of a not-for-profit organisation is that it is more expensive and complex to set up than other business structures.

7. Franchising

Franchising is a business model which involves licensing a business concept and trademarks from the franchisor to the franchisee

Table of Contents

What are the different legal structures of a business?

There are a variety of legal structures of businesses, and each has its own advantages and disadvantages. Most businesses choose from one of four structures: sole proprietorship, partnership, corporation, or limited liability company (LLC).

The sole proprietorship is the simplest form of business structure and is owned by one individual. The owner is responsible for all the debts and liabilities of the business. This structure is easy to set up and maintain, but offers no legal protection from personal liability.

A partnership is a business owned by two or more individuals. Like a sole proprietorship, the owners are personally liable for the debts and liabilities of the business. Partnership agreements can be very complex, and should be drafted with the help of an attorney.

A corporation is a business that is owned by shareholders. The shareholders are not personally liable for the debts and liabilities of the corporation. The corporation is a separate legal entity, meaning that it has its own legal rights and liabilities. In order to set up a corporation, the business must file articles of incorporation with the state.

A limited liability company (LLC) is a business structure that combines the benefits of a corporation and a partnership. LLCs are owned by members, and members are not personally liable for the debts and liabilities of the LLC. LLCs are easy to set up and maintain, and offer a high degree of flexibility.

What are the 4 types of business structures?

There are several different types of business structures a business can use. The most common are sole proprietorships, partnerships, limited liability companies, and corporations.

The most basic type of business structure is the sole proprietorship. This is a business that is owned and operated by one person. The owner is responsible for all the debts and liabilities of the business. There is no separation between the business and the owner, so the owner is also responsible for any legal problems the business may encounter.

A partnership is a business that is owned and operated by two or more people. Like a sole proprietorship, the partners are responsible for the debts and liabilities of the business. However, partnerships have more complex legal issues, and it is important to consult an attorney before starting a partnership.

A limited liability company (LLC) is a business structure that provides limited liability to the owners. This means that the owners are not personally responsible for the debts and liabilities of the business. LLCs are a popular choice for businesses that are starting out, because they are less complex than corporations and offer limited liability to the owners.

A corporation is a business structure that provides limited liability to the owners and separates the business from the owners. This means that the owners are not personally responsible for the debts and liabilities of the business. Corporations are a popular choice for businesses that are expanding or have a large number of employees.

What are the 3 types of legal structures?

When starting a business, you need to decide on the legal structure of your company. This will determine how much money you will have to pay in taxes, what kind of paperwork you will need to file, and how much liability you will have for company debts.

There are three types of legal structures: sole proprietorship, partnership, and corporation.

A sole proprietorship is the simplest type of business structure. The business is owned by one person and there is no legal distinction between the business and the owner. The owner is responsible for all debts and liabilities of the business.

A partnership is a business owned by two or more people. Partners are jointly and severally liable for the debts and liabilities of the business. This means that if one partner defaults on a debt, the other partners are responsible for paying it.

A corporation is a legal entity separate from its owners. The corporation is responsible for its own debts and liabilities. The owners (called shareholders) are not liable for the debts of the corporation. A corporation must file paperwork with the state and federal government in order to establish itself as a legal entity.

What are the 5 legal forms of business?

There are 5 main legal forms of business in the United States:

1. Sole Proprietorship

2. Partnership

3. Corporation

4. Limited Liability Company (LLC)

5. Cooperative

Each form of business has its own set of pros and cons, and the best form of business for a specific company depends on that company’s specific situation and needs.

1. Sole Proprietorship

A sole proprietorship is the simplest form of business, and it is owned and operated by a single individual. There are no required filings or paperwork to set up a sole proprietorship, and it is the easiest form of business to dissolve. The downside of a sole proprietorship is that the owner is personally liable for any debts or lawsuits against the business.

2. Partnership

A partnership is a business owned and operated by two or more individuals. Like a sole proprietorship, there are no required filings or paperwork to set up a partnership, and it is also the easiest form of business to dissolve. The downside of a partnership is that the partners are personally liable for any debts or lawsuits against the business.

3. Corporation

A corporation is a type of business that is separate and distinct from its owners. Corporations are required to file articles of incorporation with the state, and they are also required to have bylaws and a board of directors. The upside of a corporation is that the owners (the shareholders) are not personally liable for any debts or lawsuits against the business.

4. Limited Liability Company (LLC)

An LLC is a type of business that combines the features of a corporation and a partnership. LLCs are required to file articles of organization with the state, and they are also required to have operating agreements. The owners of an LLC are not personally liable for any debts or lawsuits against the business.

5. Cooperative

A cooperative is a business owned and operated by its members. Cooperatives are required to file articles of incorporation with the state. The upside of a cooperative is that the members are not personally liable for any debts or lawsuits against the business.

Why is the legal structure of a business important?

The legal structure of a business is important because it determines the rights and liabilities of the owners and employees of the business. The most common legal structures for businesses are corporations, partnerships, and limited liability companies.

A corporation is a separate legal entity from its owners and employees. This means that the corporation can own property, sue and be sued, and enter into contracts in its own name. The owners of a corporation are called shareholders, and they own shares in the corporation. The shareholders are not liable for the debts of the corporation, and the corporation is not liable for the debts of the shareholders.

A partnership is a business owned by two or more people. Partners are personally liable for the debts of the partnership. This means that if the partnership goes bankrupt, the partners will have to pay the debts of the partnership out of their own pockets.

A limited liability company is a business owned by one or more people. The owners of a limited liability company are called members. Members are not liable for the debts of the company, and the company is not liable for the debts of the members.

What are the 4 legal forms of business ownership?

There are four legal forms of business ownership: sole proprietorship, partnership, corporation, and limited liability company (LLC). Each has its own advantages and disadvantages, so it’s important to choose the right one for your business.

The most common form of business ownership is the sole proprietorship. This is a business that is owned and operated by one person. The owner is personally responsible for all debts and liabilities of the business, and profits are taxed as personal income.

A partnership is a business owned by two or more people. Partners share both the profits and losses of the business, and are personally liable for its debts.

A corporation is a business that is owned by shareholders. The shareholders are not personally liable for the debts of the business, and profits are taxed separately from personal income.

A limited liability company is a business that is owned by members. Members are not personally liable for the debts of the business, and profits are taxed separately from personal income.

What are the five 5 most common business structures?

When starting a business, one of the first decisions you’ll need to make is what business structure to use. There are five common business structures: sole proprietorship, partnership, limited liability company (LLC), corporation, and S corporation.

The structure you choose will determine how much liability you have for the business’s debts and how much control you have over the business. It will also determine how much paperwork you have to file with the government and how much tax you’ll pay.

The five most common business structures are:

1. Sole proprietorship

2. Partnership

3. Limited liability company (LLC)

4. Corporation

5. S corporation