Legal Loan Agreement Form7 min read

A loan agreement form is a legal document that sets out the terms and conditions of a loan between two or more parties. It typically includes the following information:

– The amount of the loan

– The interest rate

– The repayment schedule

– The consequences of late or missed payments

– The jurisdiction governing the agreement

A loan agreement form is an important document and should be drafted by a lawyer. It is a binding contract and can be used in the event of a dispute.

Table of Contents

How do I write a legal loan agreement?

When it comes to borrowing and lending money, it’s important to have a legal loan agreement in place. This document will spell out the terms of the loan, including the amount of money being borrowed, the interest rate, and the repayment schedule.

If you’re considering borrowing money from a friend or family member, it’s a good idea to put a legal loan agreement in place. This will help to ensure that both parties are clear on the terms of the loan, and that there is no confusion or conflict down the road.

If you’re looking to borrow money from a bank or other financial institution, you’ll likely be required to sign a loan agreement. This document will outline the terms of the loan, including the interest rate, the repayment schedule, and the amount of the loan.

When drafting a legal loan agreement, it’s important to include the following information:

– The name of the borrower and the lender

– The amount of the loan

– The interest rate

– The repayment schedule

– The consequences of defaulting on the loan

Both the borrower and the lender should sign the loan agreement, and it should be kept in a safe place. This document can be used to settle any disputes that may arise regarding the loan.

What is a legal loan agreement?

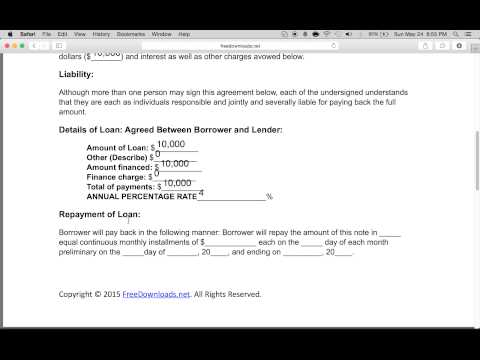

A legal loan agreement is a contract between two or more parties that outlines the terms and conditions of a loan. The agreement typically includes the amount of the loan, the interest rate, the repayment schedule, and any other pertinent information.

A legal loan agreement is important because it protects both the borrower and the lender. The agreement can be used as evidence in the event of a dispute, and it can help to prevent misunderstandings or disagreements.

It’s important to note that a legal loan agreement is not the same as a promissory note. A promissory note is a document that details the terms of a loan and the repayment schedule. A legal loan agreement is a more comprehensive document that outlines all the terms and conditions of the loan.

When drafting a legal loan agreement, it’s important to consult with an attorney to ensure that all the necessary information is included. The agreement should be clear and concise, and it should be easy to understand for all parties involved.

Are loan agreements legally binding?

Are loan agreements legally binding?

There is no one-size-fits-all answer to this question, as the legality of loan agreements will vary depending on the specific laws of the country or state in question. However, in general, loan agreements are legally binding contracts. This means that both the lender and the borrower are legally obligated to adhere to the terms of the agreement, and that any breaches of the agreement can lead to legal action.

One important thing to note is that, in most cases, a loan agreement will be considered a secured debt. This means that the lender has a legal interest in any assets that are used as security for the loan. If the borrower fails to repay the loan, the lender may be able to seize these assets to recoup their losses.

What is a free loan agreement?

A loan agreement is a contract between two parties, typically a borrower and a lender, where the borrower receives money or property from the lender in exchange for a promise to repay the lender at a later date. Loan agreements are typically used for short-term loans, such as a car loan or mortgage, but can also be used for longer-term loans, such as a student loan or home equity loan.

A free loan agreement is a loan agreement that does not require the borrower to pay any fees or interest. This type of agreement is typically used for small loans, such as a personal loan or a loan to purchase a car. A free loan agreement can be created using a loan agreement template, or by drafting the agreement yourself.

When creating a free loan agreement, it is important to include the following information:

– The name and contact information of the borrower and lender

– The amount of the loan

– The terms of the loan, including the repayment schedule and interest rate (if applicable)

– The date of the loan agreement

– The signature of the borrower and lender

Does loan agreement need to be registered?

When two or more individuals come together to lend or borrow money, they will likely have a loan agreement in place. This document spells out the terms of the loan, including the interest rate, the repayment schedule, and any late fees that may apply.

While a loan agreement is not legally required, it’s a good idea to have one in place anyway. This helps to protect both the lender and the borrower in the event of a dispute. If there is no loan agreement in place, the lender may be able to sue the borrower for repayment, and the borrower may not be able to dispute the amount that they owe.

If you’re looking to create a loan agreement, there are a few things to keep in mind. The agreement should be clear and concise, and it should include all the important details of the loan. It’s also a good idea to have the agreement notarized, so that it will be legally binding.

If you’re unsure of whether or not your loan agreement needs to be registered, you can speak to a lawyer or legal professional for advice.

Should loan agreement be notarized?

A loan agreement is a written document that sets out the terms and conditions of a loan. It is usually signed by the borrower and the lender. In some cases, a loan agreement may be notarized.

There are several reasons why a loan agreement might be notarized. One reason is to provide additional evidence of the terms of the loan agreement. Notarization can also help to protect both the borrower and the lender in the event of a dispute.

Notarization is not always required, and it is important to check with your state or local government to see if it is necessary in your area. If you decide to have your loan agreement notarized, be sure to consult with a notary public to make sure you understand the process and what is required.

Does a loan agreement need to be witnessed?

When two or more people enter into a legal agreement, it is usually done so in the presence of a notary public who witnesses their signatures. A loan agreement does not typically require this same level of formal witnessing, though it is always a good idea to have some form of documentation in case of any potential legal disputes.

That said, some banks or other lending institutions may require that a loan agreement be notarized in order to finalize the loan. This is generally done as a form of protection for the lending institution, as it ensures that the agreement has been properly executed and is therefore binding.

If you are in doubt about whether or not your loan agreement needs to be notarized, it is always best to check with the lending institution before signing anything. They will be able to tell you what specific steps need to be taken in order to finalize the loan. Failing to follow their instructions may result in the agreement being invalid, so it is important to take this process seriously.