Legal Mileage Reimbursement Rate 20165 min read

The IRS has released the 2016 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. The rates are:

54 cents per mile for business miles driven

14 cents per mile driven for medical or moving purposes

14 cents per mile driven in service of charitable organizations

The IRS also announced the maximum standard automobile cost that may be used in calculating the business mileage deduction. For 2016, the maximum standard automobile cost is $30,000.

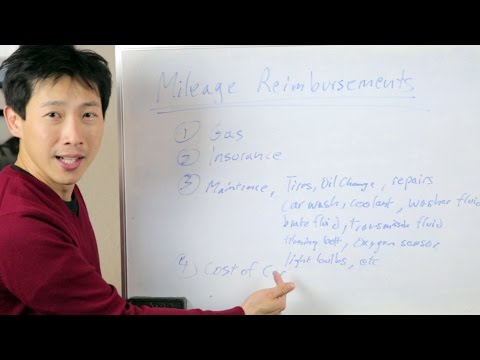

The business standard mileage rate is based on the cost of operating an automobile, including depreciation, insurance, repairs, and tires. The medical and moving rate is based on the costs of operating an automobile for medical or moving purposes, including depreciation, insurance, and gas. The charitable rate is based on the costs of operating an automobile for charitable purposes, including depreciation, insurance, and gas.

Table of Contents

What is the CRA mileage rate for 2017?

The CRA mileage rate for 2017 is 54 cents per kilometer. This is the rate that the CRA will use to calculate the amount of tax-deductible mileage expenses for business use. If you are using your own vehicle for business purposes, you can claim a deduction for the expenses related to that use, including gasoline, repairs, and depreciation. To calculate your deduction, multiply the number of kilometers you drove for business purposes by the CRA mileage rate.

If you are using a vehicle for personal and business purposes, you can only claim the business-related expenses. Personal expenses, such as the cost of gasoline, are not tax-deductible.

The CRA mileage rate for 2017 is subject to change, so be sure to check back periodically for updates.

Does NH require mileage reimbursement?

In New Hampshire, there is no law that specifically states that an employer must reimburse employees for mileage expenses incurred while performing work-related tasks. However, there are a few laws that could be interpreted to require such reimbursement.

The first is the state’s Wage and Hour law. This law requires that employees be paid for all hours worked, including those that are not performed in the employee’s primary job duties. In some cases, mileage incurred while performing work-related tasks may be considered hours worked.

The second law that could be interpreted to require mileage reimbursement is the state’s Unemployment Insurance law. This law requires employers to reimburse employees for travel expenses that are “necessary and required” for the employee to perform their job duties. Mileage expenses may be considered necessary and required for some employees, depending on their job duties.

Ultimately, whether or not an employer in New Hampshire is required to reimburse employees for mileage expenses depends on the specific circumstances. If you are unsure whether or not you are entitled to reimbursement, it is best to speak with an attorney.

Do employers have to pay mileage in NY?

In New York, employers are not required to pay their employees for mileage. However, employers may choose to do so as a benefit or incentive.

Employees in New York are generally not entitled to any kind of mileage reimbursement from their employers. This is based on a state law that states that employees are only entitled to reimbursement for ” expenses actually incurred and reasonable in amount.”

This law applies to both private employers and government employers. However, there are a few exceptions. For example, if an employee is required to use their personal vehicle for work-related purposes, the employee may be able to claim a deduction for their business mileage.

There are also a few cities in New York that have passed their own mileage reimbursement laws. For example, in the city of Buffalo, employees are entitled to receive a reimbursement of 25 cents per mile. However, these laws are not widespread, and most employees in New York will not be entitled to any reimbursement.

So, in short, employers in New York are not required to pay their employees for mileage, but they may choose to do so as a benefit or incentive. Employees in New York may be able to claim a deduction for their business mileage if they are required to use their personal vehicle for work-related purposes. However, most employees in New York will not be entitled to any reimbursement.

Is an employer required to reimburse for mileage in California?

In California, employers are not required to reimburse employees for mileage. However, there are some exceptions. If the employer requires the employee to use their personal vehicle for work-related purposes, the employer must reimburse the employee for the mileage. Additionally, if the employer contracts with a third party to provide transportation for their employees, the employer is not required to reimburse the employees for mileage.

What is the CRA mileage rate for 2018?

The CRA mileage rate for 2018 is 58 cents per kilometer. This rate is for business use of a personal vehicle. For medical or moving purposes, the rate is 56 cents per kilometer.

What is CRA mileage rate?

The CRA mileage rate is the rate at which the Canada Revenue Agency (CRA) allows taxpayers to claim a deduction for the cost of using their vehicle for business purposes. The CRA mileage rate is currently 54 cents per kilometre.

To claim the CRA mileage rate, taxpayers must keep a record of the kilometres they drove for business purposes. They must also have a written explanation of the business purpose for each trip.

The CRA mileage rate is a percentage of the cost of using a vehicle for business purposes. The cost of using a vehicle for business purposes includes the cost of fuel, oil, repairs, and depreciation.

The CRA mileage rate is a good option for taxpayers who do a lot of business travel. It is also a good option for taxpayers who do not have a vehicle that is eligible for the capital cost allowance (CCA) deduction.

What is the km rate for 2022?

What is the km rate for 2022?

This is a difficult question to answer, as it largely depends on the specific needs of each individual. However, in general, the average km rate for 2022 is likely to be around $0.22 per km. This is based on current market conditions and the average rates charged by different providers.

If you need to travel a long distance, it is always important to compare rates from different providers to get the best deal. It is also important to be aware of any hidden fees that may be charged, such as for delivery or tolls.

Finally, it is always important to read the terms and conditions of any contract before signing up, to ensure that you are fully aware of what you are agreeing to.