Pot Legal In Illinois3 min read

On May 31, Illinois became the 11th state in the US to legalize recreational marijuana. Adults over the age of 21 can now possess, purchase, and consume marijuana.

Although Illinois is the latest state to legalize recreational marijuana, it is not the first. In January 2019, Vermont became the first state to legalize marijuana through the legislative process. Other states, such as Colorado and Washington, legalized marijuana through voter initiatives.

What does this mean for Illinois residents?

Adults over the age of 21 can now possess, purchase, and consume marijuana.

Marijuana will be taxed at a rate of 10%.

Residents will be allowed to grow up to five plants.

Marijuana cannot be consumed in public.

What are the benefits of legalization?

Research suggests that marijuana legalization can have a number of benefits, including:

Reduced crime rates

Reduced rates of opioid addiction

Increased tax revenue

What are the risks of legalization?

There are some risks associated with marijuana legalization, including:

Increased rates of marijuana use

Increased rates of marijuana addiction

Increased rates of car accidents

What do you think?

Do you think marijuana should be legalized? Why or why not?

Table of Contents

Is pot recreationally legal in Illinois?

Yes, pot is recreationally legal in Illinois. In 2013, the Illinois General Assembly passed the Illinois Cannabis Regulation and Tax Act, which allows people aged 21 and over to possess and consume up to 30 grams of cannabis flower, 5 grams of cannabis concentrate, and 500 milligrams of THC contained in edibles. The Act also allows adults to grow up to five cannabis plants in their homes.

The Illinois Cannabis Regulation and Tax Act imposes a sliding-scale excise tax on cannabis sales. The tax rates range from 10% to 25%, depending on the amount of THC in the cannabis product. The Act also establishes a regulatory framework for the cultivation, processing, and sale of cannabis products.

The Illinois Cannabis Regulation and Tax Act took effect on January 1, 2020. However, the Illinois Department of Revenue is still in the process of developing rules and regulations for the implementation of the Act. Until the Department of Revenue issues final rules and regulations, cannabis products cannot be sold in Illinois.

Can I buy recreational in Illinois?

In Illinois, adults aged 21 and over are able to purchase recreational cannabis. However, there are some restrictions in place.

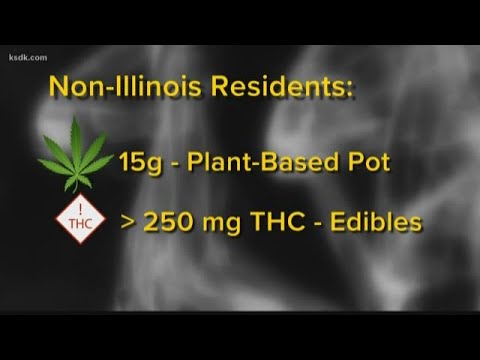

For starters, only residents of Illinois are able to purchase recreational cannabis. Non-residents are not able to purchase cannabis, even if they are of legal age.

Furthermore, cannabis can only be purchased from licensed dispensaries. It is not possible to purchase cannabis from other sources, such as online or from a dealer.

Dispensaries are only allowed to sell cannabis to adults aged 21 and over. It is not possible to purchase cannabis if you are under 21.

In terms of quantities, adults are able to purchase up to 30 grams of cannabis at a time.

Cannabis is taxed at a rate of 10% in Illinois.

Can you buy edibles in Illinois?

Yes, you can buy edibles in Illinois, but there are a few things you should know before you do.

First of all, it’s important to understand that edibles are subject to the same restrictions as other cannabis products. In other words, you can only purchase them from licensed dispensaries, and you can only consume them in private.

It’s also worth noting that edibles come in a variety of different forms, so you should be sure to choose one that’s right for you. Some of the most popular options include brownies, cookies, and candy.

Finally, it’s important to remember that edibles can take a while to kick in, so be patient and give it time. If you don’t feel anything after an hour or so, you may want to try a higher dosage.