Type Of Legal Entity8 min read

When starting a business, one of the initial decisions you’ll need to make is what type of legal entity to form. This decision will have a major impact on your business operations and future.

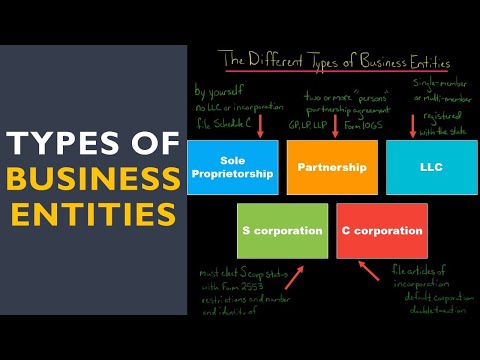

There are several types of legal entities to choose from, each with its own advantages and disadvantages. The most common types are the sole proprietorship, partnership, limited liability company (LLC), and corporation.

Sole Proprietorship

A sole proprietorship is the simplest business structure and is owned by one individual. There is no separate legal entity, so the owner is personally liable for all business debts and obligations. This type of business is easy and inexpensive to set up, and there are no ongoing formalities requirements. However, the owner is responsible for all losses and profits, and the business is not protected from personal liability in the event of a lawsuit.

Partnership

A partnership is a business owned by two or more individuals. Like a sole proprietorship, there is no separate legal entity, and the owners are personally liable for all business debts and obligations. Partnership agreements can be very detailed, spelling out the rights and responsibilities of the partners, but they are not required by law. In the event of a lawsuit, the partners are each liable for the entire amount of the judgment.

Limited Liability Company

A limited liability company (LLC) is a separate legal entity, owned by one or more individuals. The owners are not personally liable for the company’s debts and obligations. LLCs are easy and inexpensive to set up, and there are no ongoing formalities requirements. However, the company must have a written operating agreement which spells out the rights and responsibilities of the owners.

Corporation

A corporation is a separate legal entity, owned by one or more individuals. The owners are not personally liable for the company’s debts and obligations. A corporation is more expensive and complex to set up than other types of businesses, and there are ongoing formalities requirements. However, a corporation offers the greatest protection from personal liability in the event of a lawsuit.

Table of Contents

What are the 5 entity types?

There are five main entity types in the world: individuals, organizations, governments, international organizations, and natural persons.

Individuals are the simplest type of entity, and are the basic building blocks of society. They are the only entities that have natural rights, which are the rights that are inherent in humans and cannot be taken away. Individuals can own property, make contracts, and sue or be sued.

Organizations are entities that are composed of two or more individuals. They can own property, make contracts, and sue or be sued. The most common type of organization is a corporation, which is a business that has been registered with the government.

Governments are entities that have been granted the authority to make laws and to enforce them. They can own property, make contracts, and sue or be sued.

International organizations are organizations that have been formed by two or more governments. They can own property, make contracts, and sue or be sued. The most famous international organization is the United Nations.

Natural persons are individuals who are not considered to be organizations or governments. They can own property, make contracts, and sue or be sued.

What are three different types of legal entities?

There are three different types of legal entities: corporations, limited liability companies (LLCs), and partnerships. Each type has its own benefits and drawbacks, so it’s important to choose the right one for your business.

A corporation is a legal entity that is separate and distinct from its owners. It has its own rights, privileges, and liabilities, and it can sue and be sued in its own name. Corporations are more complex and expensive to set up than other types of legal entities, but they offer more protection for the owners.

A limited liability company (LLC) is a hybrid entity that combines the benefits of a corporation and a partnership. LLCs are easy to set up and manage, and they offer limited liability protection for the owners. However, LLCs are not as well-known as corporations, so they may not be as suitable for larger businesses.

A partnership is a simple and inexpensive way to form a business. Partnerships are not separate legal entities, so the partners are personally liable for the debts and liabilities of the business. This can be a downside, but it also means that partnerships are very easy to set up.

What are the 4 business entity types?

There are several different types of business entities that you can choose from when starting your own company. The most common are sole proprietorships, partnerships, limited liability companies (LLCs), and corporations.

Sole proprietorships are the simplest type of business entity. There is only one owner, and the owner is personally liable for all the debts and obligations of the business.

Partnerships are also relatively simple. There are two or more owners, and each owner is liable for the debts and obligations of the business. However, partnerships offer more flexibility than sole proprietorships. For example, partners can agree to different levels of ownership and management.

LLCs are similar to partnerships, but offer limited liability protection for the owners. This means that the owners are not personally liable for the debts and obligations of the LLC.

Corporations are the most complex type of business entity. There are shareholders, and the corporation is a separate legal entity from the shareholders. This means that the shareholders are not personally liable for the debts and obligations of the corporation.

What is legal entity example?

A legal entity is an organization that has been given a legal status by a government. This means that the legal entity has certain rights and obligations that are protected by law. There are many different types of legal entities, each with their own specific set of rules and regulations.

The most common types of legal entities are corporations and limited liability companies. Corporations are owned by shareholders, who have a financial interest in the company. Limited liability companies are owned by members, who are not personally liable for the company’s debts or obligations.

There are also many other types of legal entities, including partnerships, sole proprietorships, and trusts. Each type of legal entity has its own set of rules and regulations, which must be followed in order to maintain the organization’s legal status.

It is important to understand the differences between the different types of legal entities, as each one has its own specific benefits and drawbacks. It is also important to consult with an attorney or other legal professional in order to determine which type of legal entity is best for your specific business needs.

What legal entity means?

What legal entity means?

A legal entity is an organization that has a separate legal personality from its owners. It can enter into contracts, own assets and incur liabilities.

There are a number of different types of legal entities, including corporations, limited liability companies, partnerships and trusts. Each one has its own specific set of rules and regulations.

Choosing the right legal entity is an important decision for business owners. It can have a significant impact on how the business is run and the amount of liability the owners are exposed to.

It is important to consult with a lawyer to discuss the different options and decide which one is the best fit for your business.

What is a legal entity name?

A legal entity name is the name of a company, partnership, or other legal organization. A legal entity name is also called a business name or trade name. A legal entity name must be unique and can be used in business filings, advertisements, and other legal documents.

What is legal entity type mean?

There are a variety of legal entity types that a business can choose from. Each type has its own benefits and drawbacks, so it’s important to choose the type that is best suited for your business.

The most common legal entity types are sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Let’s take a closer look at each of these types:

Sole Proprietorships: A sole proprietorship is the simplest type of business entity. It is owned by a single person and there is no legal distinction between the business and the owner. This type of business is easy to set up and is the least expensive to operate. However, the owner is personally liable for all debts and liabilities of the business.

Partnerships: A partnership is a business entity that is owned by two or more people. Partners are personally liable for the debts and liabilities of the business. Partnership agreements should set out the rights and responsibilities of the partners, as well as how profits and losses will be shared.

Limited Liability Companies: A limited liability company (LLC) is a business entity that offers limited liability protection to its owners. LLCs are popular because they are relatively easy to set up and offer a lot of flexibility. Owners are not personally liable for the debts and liabilities of the LLC.

Corporations: A corporation is a legal entity that is separate from its owners. Corporations are more complex to set up than other types of businesses, but offer more benefits, such as limited liability protection and the ability to raise capital. Owners of a corporation are not personally liable for the debts and liabilities of the corporation.