Types Of Legal Structures11 min read

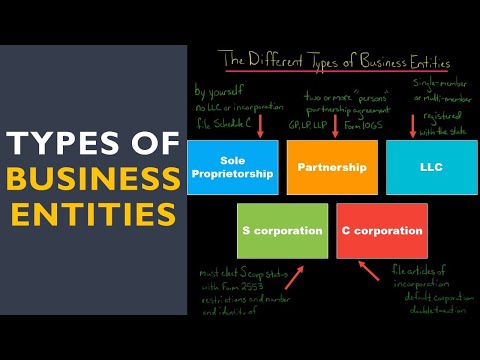

There are several types of legal structures a business can choose from when starting up. The most common are sole proprietorships, partnerships, and corporations. Each type of legal structure has its own benefits and drawbacks, so it’s important to understand the differences before making a decision.

Sole Proprietorships

A sole proprietorship is the simplest legal structure and is owned by a single individual. This type of business is easy and inexpensive to set up, and there are no annual fees. However, the owner is personally responsible for all debts and liabilities of the business.

Partnerships

A partnership is a business owned by two or more individuals. Like a sole proprietorship, there are no annual fees, and it’s easy and inexpensive to set up. However, partners are also personally responsible for the debts and liabilities of the business.

Partnerships can be structured in several different ways, including general partnerships, limited partnerships, and limited liability partnerships. General partnerships are the simplest type, and all partners are equally responsible for the business. Limited partnerships have both general and limited partners. The general partners are responsible for the day-to-day operations of the business, and the limited partners are only liable for the amount of money they’ve invested in the partnership. Limited liability partnerships are similar to limited partnerships, but all partners have limited liability. This means that they are only liable for the amount of money they’ve invested in the partnership, and they are not personally responsible for the debts and liabilities of the business.

Corporations

A corporation is a legal entity that is separate from its owners. This type of legal structure is more complex and expensive to set up than the others, but it offers several benefits. A corporation is a separate legal entity, which means that its owners are not personally responsible for the debts and liabilities of the business. Corporations also have a higher level of credibility and are seen as more professional than other types of businesses.

There are several different types of corporations, including C-corporations, S-corporations, and limited liability corporations. C-corporations are the most common type and are taxed as a separate entity. S-corporations are taxed as individuals, which can save money on taxes. Limited liability corporations offer the benefits of both C-corporations and S-corporations.

Table of Contents

What are the six types of legal structures?

There are six types of legal structures in the world: sole proprietorship, general partnership, limited partnership, limited liability company, C corporation, and S corporation. Each type of legal structure has its own benefits and drawbacks, so it’s important to choose the right one for your business.

The most common type of legal structure is the sole proprietorship. This is a business that is owned by one person and is not a separate legal entity. The owner is personally liable for any debts or lawsuits against the business.

A general partnership is a business that is owned by two or more people. Like a sole proprietorship, it is not a separate legal entity and the owners are personally liable for any debts or lawsuits.

A limited partnership is a business that is owned by two or more people, but only one of the owners is liable for any debts or lawsuits. The other owners are protected from personal liability.

A limited liability company (LLC) is a business that is owned by one or more people. The owners are protected from personal liability for any debts or lawsuits against the company.

A C corporation is a business that is owned by one or more people, but it is a separate legal entity from the owners. The owners are not liable for any debts or lawsuits against the company. C corporations are subject to corporate income tax, and they can also issue stock.

An S corporation is a business that is owned by one or more people, but it is a separate legal entity from the owners. The owners are not liable for any debts or lawsuits against the company. S corporations are not subject to corporate income tax, but they can only issue stock that is owned by individuals.

What are the four legal structures?

There are four primary legal structures used in business: sole proprietorship, partnership, corporation, and limited liability company (LLC). Each has its own benefits and drawbacks, so it’s important to choose the one that’s best suited for your business.

The sole proprietorship is the simplest and most common business structure. It’s owned and operated by a single individual, and there’s no legal distinction between the business and the owner. This structure is easy to set up and comes with a range of tax benefits. However, the owner is personally liable for any debts or lawsuits the business may incur.

Partnerships are similar to sole proprietorships, but they involve more than one owner. Partnerships are also easy to set up, and they offer some tax benefits, too. However, partners are also personally liable for the business’ debts and liabilities.

A corporation is a more complex business structure, but it offers several advantages. For one, corporations are considered separate legal entities from their owners, so they’re not personally liable for the business’ debts. They’re also easier to raise money through equity or debt financing. However, corporations are more expensive to set up and are subject to stricter regulations.

The LLC is a newer business structure that combines the benefits of partnerships and corporations. LLCs are easy to set up and are considered separate legal entities, but they’re less regulated than corporations. This makes them a good option for small businesses that want the protections of a corporation without the extra paperwork and costs.

So, which legal structure is right for your business? That depends on your specific situation and needs. Talk to a lawyer or accountant to learn more about the pros and cons of each structure and decide which is the best fit for you.

What is the legal structure?

When it comes to the legal structure of a business, there are a few different options to choose from. The most common legal structures are corporations, limited liability companies (LLCs), and partnerships. Each has its own set of benefits and drawbacks, so it’s important to choose the one that’s the best fit for your business.

A corporation is a legal entity that is separate from its owners. This means that the corporation can own property, enter into contracts, and sue and be sued in its own name. Corporations are typically more expensive and complex to set up than other legal structures, but they offer limited liability protection for their owners. This means that the owners are shielded from any financial liability incurred by the corporation.

An LLC is a hybrid entity that combines the benefits of a corporation and a partnership. LLCs are relatively simple and inexpensive to set up, and they offer limited liability protection for their owners. However, LLCs are not considered separate legal entities, which means that the owners are personally liable for any debts or lawsuits incurred by the LLC.

Partnerships are the simplest and least expensive legal structure for a business. Partnerships are created when two or more people agree to own and operate a business together. Partnerships offer limited liability protection for their owners and are not considered separate legal entities. This means that the partners are personally liable for any debts or lawsuits incurred by the partnership.

What are the 4 types of ownership?

There are four types of business ownership: sole proprietorship, partnership, corporation, and limited liability company (LLC). Each type of business has different benefits and drawbacks.

The first type of ownership is the sole proprietorship. A sole proprietorship is a business that is owned and operated by one person. The owner is responsible for all of the debts and liabilities of the business. The owner also receives all of the profits from the business. This type of business is the simplest to set up and is the least expensive. However, the owner of a sole proprietorship is personally liable for any debts or lawsuits against the business.

The second type of business ownership is the partnership. A partnership is a business that is owned and operated by two or more people. Partners share the responsibilities and liabilities of the business. They also share the profits and losses of the business. Partnerships are relatively easy to set up and are less expensive than corporations. However, partnerships can be difficult to manage and can be subject to disputes between partners.

The third type of business ownership is the corporation. A corporation is a business that is owned by shareholders. The shareholders are responsible for the debts and liabilities of the corporation. The corporation also has its own legal personality, which means that it can enter into contracts and sue and be sued. The corporation is more expensive to set up than other types of businesses. However, it offers the owners limited liability, which means that the owners are not personally liable for the debts of the corporation.

The fourth type of business ownership is the LLC. An LLC is a business that is owned by members. The members are responsible for the debts and liabilities of the LLC. The LLC also has its own legal personality. The LLC is more expensive to set up than other types of businesses. However, it offers the owners limited liability.

How many types of legal structures are there?

There are a variety of legal structures businesses can use when starting up. The most common are sole proprietorships, partnerships, and corporations.

A sole proprietorship is the simplest form of business organization. There is no legal distinction between the business and the owner. The business is not a separate legal entity, and the owner is personally liable for all the debts of the business.

A partnership is a business owned by two or more people. Partners are jointly and severally liable for the debts of the business. This means that each partner is liable for the entire debt, and the partnership can’t sue one partner to collect on the debt.

A corporation is a legal entity separate from its owners. The owners of a corporation are called shareholders. The corporation can sue and be sued in its own name. Shareholders are not liable for the debts of the corporation.

What are the 5 entity types?

There are five main types of legal entities: individuals, partnerships, limited partnerships, corporations, and limited liability companies. Each type of entity has different benefits and drawbacks, so it’s important to choose the right one for your business.

Individuals are the simplest type of entity, and they’re the only type that doesn’t have to register with the state. Individuals can do business under their own name, and they’re responsible for their own debts and obligations.

Partnerships are formed when two or more individuals come together to do business. Partnerships have many of the same benefits and drawbacks as individuals, but they’re also subject to special rules and regulations. For example, partnerships must file annual reports with the state, and the partners are jointly and severally liable for the partnership’s debts and obligations.

Limited partnerships are similar to regular partnerships, but they have one or more general partners and one or more limited partners. General partners are responsible for the partnership’s debts and obligations, while limited partners are not. Limited partnerships must file annual reports with the state, and the limited partners are liable for the partnership’s debts to the extent of their investment.

Corporations are the most complex type of entity, and they’re also the most expensive to set up. Corporations have many of the same benefits and drawbacks as partnerships, but they’re also subject to special rules and regulations. For example, corporations must file annual reports with the state, and the shareholders are liable for the corporation’s debts to the extent of their investment.

Limited liability companies are the most popular type of entity, and they offer the benefits of both corporations and limited partnerships. LLCs are easy to set up and manage, and they offer limited liability for the owners. LLCs must file annual reports with the state, and the owners are liable for the LLC’s debts to the extent of their investment.

How many legal structures are there?

There are many different legal structures around the world, each with their own benefits and drawbacks. Some of the most common legal structures are sole proprietorship, partnership, corporation, and limited liability company.

A sole proprietorship is the simplest legal structure, and is owned by one person. This is the most common form of business in the United States. The owner of a sole proprietorship is personally liable for any debts or lawsuits against the business.

A partnership is also owned by one or more people, but partners are not personally liable for the debts of the business. Partnership agreements can be very complex, and it is important to specify who is responsible for what in the event of a dispute.

A corporation is a separate legal entity, and the owners (shareholders) are not personally liable for the debts of the company. A corporation must file articles of incorporation with the state and follow a number of regulations.

A limited liability company (LLC) is a newer form of business structure that combines the benefits of a corporation and a partnership. The owners of an LLC are not personally liable for the debts of the company, and the company is not required to follow the same regulations as a corporation.