Types Of Legal Business Structures11 min read

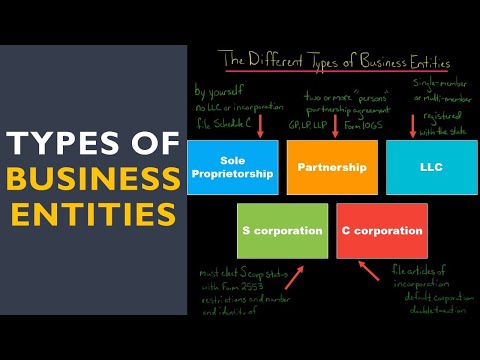

There are many different types of legal business structures, each with its own set of benefits and drawbacks. The most common types of legal business structures are sole proprietorships, partnerships, corporations, and limited liability companies (LLCs).

Sole proprietorships are the simplest type of business structure. They are owned and operated by a single individual and have no legal distinction between the business and the owner. As a result, the owner is personally responsible for all the debts and liabilities of the business.

Partnerships are similar to sole proprietorships, but are owned and operated by two or more individuals. Like sole proprietorships, partnerships have no legal distinction between the business and the owners, so the partners are personally responsible for the business’s debts and liabilities.

Corporations are more complex than sole proprietorships and partnerships, and offer more legal protections for business owners. Corporations are owned by shareholders, who elect a board of directors to oversee the company. The shareholders and directors are not personally responsible for the company’s debts and liabilities, meaning that the corporation can’t go bankrupt if one of its owners fails to pay their debts.

Limited liability companies (LLCs) are a newer type of business structure that offer the legal protections of a corporation combined with the simplicity of a sole proprietorship or partnership. LLCs are owned by members, who are not personally responsible for the company’s debts and liabilities. This makes LLCs a popular choice for small businesses that want the legal protections of a corporation without the complexity and expense of setting up a full-blown corporation.

Table of Contents

What are the 4 types of business structures?

There are four types of business structures in the United States: sole proprietorship, partnership, limited liability company (LLC), and corporation. The business structure you choose will have a big impact on your taxes, liability, and paperwork.

Sole Proprietorship

The simplest business structure is the sole proprietorship. This is an unincorporated business owned by one person. The owner is responsible for all the debts and liabilities of the business, and the profits are taxed as personal income. There is no separate legal entity, so the owner is personally liable for any legal action against the business.

Partnership

A partnership is a business owned by two or more people. Like a sole proprietorship, the partners are personally liable for any debts or lawsuits against the business. The profits are taxed as personal income, and each partner pays self-employment tax on their share of the profits.

Limited Liability Company (LLC)

An LLC is a hybrid business structure that offers the limited liability of a corporation and the tax advantages of a partnership. An LLC is a separate legal entity, so the owners are not personally liable for any debts or lawsuits against the business. The profits are taxed as personal income, but the owners can elect to pay taxes as a corporation.

Corporation

A corporation is a separate legal entity owned by shareholders. The shareholders are not personally liable for any debts or lawsuits against the corporation. The profits are taxed as corporate income, and the shareholders pay income tax on their share of the profits.

What are the six types of legal structures?

There are six types of legal structures in the United States: sole proprietorship, partnership, limited liability company (LLC), C-corporation, S-corporation, and nonprofit. The most common are the LLC and C-corporation.

A sole proprietorship is the simplest and most common business structure. It is owned by one person and there is no legal distinction between the owner and the business. The business is not a separate entity and the owner is personally liable for all business debts and obligations.

A partnership is also owned by one or more people, but there is a legal distinction between the owner(s) and the business. Partners are personally liable for business debts and obligations, but the business is not liable for the debts of the individual partners.

A limited liability company (LLC) is a newer type of business structure that offers the limited liability of a corporation combined with the tax advantages of a partnership. An LLC is owned by one or more people, but is a separate entity from the owners. The business is not liable for the debts of the individual owners and profits and losses are passed through to the owners and taxed on their individual tax returns.

A C-corporation is a traditional corporation with limited liability for its owners. A C-corporation is a separate entity from its owners and is taxed separately from its owners.

An S-corporation is a corporation that has elected “Subchapter S” tax treatment. An S-corporation is a separate entity from its owners and is taxed separately from its owners. Profits and losses are passed through to the owners and taxed on their individual tax returns.

A nonprofit is a business that is organized for a charitable or other purpose that is not profit-oriented. A nonprofit is a separate entity from its owners and is taxed separately from its owners.

What are the different legal structures of a business?

There are a variety of legal structures a business can use, and the most appropriate structure depends on the size and scope of the business. The most common legal structures are sole proprietorship, partnership, corporation, and limited liability company.

Sole proprietorship is the simplest business structure and is owned by one person. There are no formal registration requirements, and the owner is responsible for all business debts and liabilities.

Partnership is a business structure owned by two or more people. There are no formal registration requirements, and the partners are responsible for all business debts and liabilities.

Corporation is a business structure owned by one or more people. A corporation is a separate legal entity from its owners and is responsible for its own debts and liabilities. In order to form a corporation, the owners must file articles of incorporation with the state.

Limited liability company (LLC) is a business structure owned by one or more people. An LLC is a separate legal entity from its owners and is responsible for its own debts and liabilities. In order to form an LLC, the owners must file articles of organization with the state.

What are the 5 most common types of business structure?

There are a variety of options for structuring a business. The most common types are sole proprietorship, partnership, limited liability company (LLC), corporation, and S corporation.

1. Sole proprietorship: A sole proprietorship is the simplest and most common form of business structure. It is owned and operated by a single individual. There are no formal documents or filings required to establish a sole proprietorship. The owner simply begins doing business under their own name or trade name. A sole proprietorship is not a separate legal entity and the owner is personally liable for all debts and obligations of the business.

2. Partnership: A partnership is a business owned and operated by two or more individuals. Like a sole proprietorship, there are no formal documents or filings required to establish a partnership. The partnership agreement is a contract between the partners that governs the operation of the business. Partners are personally liable for the debts and obligations of the partnership.

3. Limited liability company (LLC): An LLC is a separate legal entity created by filing Articles of Organization with the state. The owners of an LLC are called members. An LLC offers the limited liability protection of a corporation with the flexibility of a partnership. LLCs are popular because they are easy to set up and maintain, and offer the benefits of limited liability protection.

4. Corporation: A corporation is a separate legal entity created by filing Articles of Incorporation with the state. The owners of a corporation are called shareholders. A corporation offers the limited liability protection of a LLC with the advantages of continuity of life, increased credibility, and easier access to capital.

5. S corporation: An S corporation is a corporation that has elected to be treated as a pass-through entity for tax purposes. This means that the income and losses of the corporation are passed through to the shareholders and are reported on their individual tax returns. S corporations are popular because they offer the limited liability protection of a corporation and the tax benefits of a partnership.

What are the 3 legal forms of business?

There are three legal forms of business in the United States: the corporation, the limited liability company (LLC), and the partnership. The type of business you choose will determine the amount of personal liability you face if the business is sued.

A corporation is a legal entity that is separate from its owners. This means that the corporation can own property, enter into contracts, and sue or be sued in its own name. The owners of a corporation are called shareholders. They own shares in the company and have a vote in important decisions, such as whether to issue new shares or sell the company. Shareholders are not personally liable for the debts of the company.

A limited liability company is a hybrid entity that combines the characteristics of a corporation and a partnership. Like a corporation, an LLC is a separate legal entity that can own property, enter into contracts, and sue or be sued. However, like a partnership, the owners of an LLC are personally liable for the debts of the company.

A partnership is a business owned by two or more people. Partners are personally liable for the debts of the business. Partnerships can be general partnerships, in which all partners are liable for the debts of the business, or limited partnerships, in which some partners are liable for the debts of the business and some are not.

What are the 4 legal forms of business ownership?

There are four main legal forms of business ownership: sole proprietorship, partnership, limited liability company (LLC), and corporation. Each has its own benefits and drawbacks, so it’s important to choose the right one for your business.

Sole proprietorship is the simplest form of business ownership. With this setup, the business is owned and operated by a single individual. There are no formal registration or filing requirements, and the owner is personally liable for all business debts and obligations.

Partnership is similar to a sole proprietorship, but it involves two or more owners. Like a sole proprietorship, there are no registration or filing requirements, and partners are personally liable for business debts and obligations. However, partnerships can be more complicated to manage than sole proprietorships, and disputes between partners can be difficult to resolve.

Limited liability company (LLC) is a newer form of business ownership that offers some of the benefits of both partnerships and corporations. LLCs are easy to set up and manage, and owners are not personally liable for business debts and obligations. However, LLCs are not as well-known as other forms of business ownership, so they may be less attractive to investors or customers.

Corporation is the most complex form of business ownership, but it also offers the most benefits. Corporations are separate legal entities, which means that owners are not personally liable for business debts and obligations. Corporations also have a number of legal and tax advantages, and they are the most common form of business ownership in the United States.

What are the 5 different legal forms of business ownership?

There are five common legal forms of business ownership in the United States:

1. Sole proprietorship: A sole proprietorship is the simplest and most common form of business ownership. Owned and operated by a single individual, a sole proprietorship is not a separate legal entity from its owner and has no separate legal status. All assets and liabilities of the business belong to the owner.

2. Partnership: A partnership is a business owned by two or more individuals. Partners share ownership and responsibilities for the business, and profits and losses are split among the partners according to their ownership share.

3. Corporation: A corporation is a separate legal entity from its owners and has its own legal status. Corporations are owned by shareholders, who elect a board of directors to make decisions on behalf of the company. Corporations can be either for-profit or nonprofit.

4. Limited liability company (LLC): An LLC is a relatively new form of business ownership that combines the features of a corporation and a partnership. LLCs are owned by members, who share ownership and responsibilities for the business. LLCs offer limited liability protection for their owners, meaning that members are not personally liable for the debts of the company.

5. Nonprofit organization: A nonprofit organization is a business that does not make a profit for its owners. Nonprofits are typically organized as corporations or LLCs, and their owners are typically called directors or members.